Rise of 5G Technology

The advent of 5G technology is poised to significantly impact the virtual network-functions market. With its promise of ultra-fast data speeds and low latency, 5G is expected to drive the demand for advanced network solutions that can leverage these capabilities. The virtual network-functions market is likely to benefit from the increased need for network slicing and dynamic resource allocation, which are essential for optimizing 5G networks. Industry analysts suggest that the deployment of 5G could lead to a market expansion of over $100 billion by 2026, highlighting the potential for growth within the virtual network-functions market as telecommunications providers seek to enhance their service offerings.

Regulatory Compliance and Standards

Regulatory compliance is a pivotal factor influencing the virtual network-functions market. As data privacy and security regulations become more stringent, organizations are compelled to adopt solutions that ensure compliance with these standards. This market is adapting to these requirements by offering solutions that facilitate compliance with regulations such as GDPR and HIPAA. This trend is particularly relevant in sectors like healthcare and finance, where data protection is paramount. The increasing focus on regulatory compliance is expected to drive innovation and investment in the virtual network-functions market, as companies seek to align their operations with legal requirements while enhancing their service offerings.

Increased Focus on Network Automation

Network automation is becoming an essential driver in the virtual network-functions market. As organizations strive for greater efficiency and reduced human error, the automation of network management processes is gaining traction. This shift is particularly relevant in large enterprises where complex network environments can benefit from automated solutions. The virtual network-functions market is responding to this trend by providing tools that facilitate automation, thereby enhancing operational efficiency. It is estimated that automation can reduce network management costs by up to 40%, making it a compelling proposition for businesses looking to optimize their network operations. This focus on automation is likely to continue shaping the landscape of the virtual network-functions market.

Growing Demand for Network Scalability

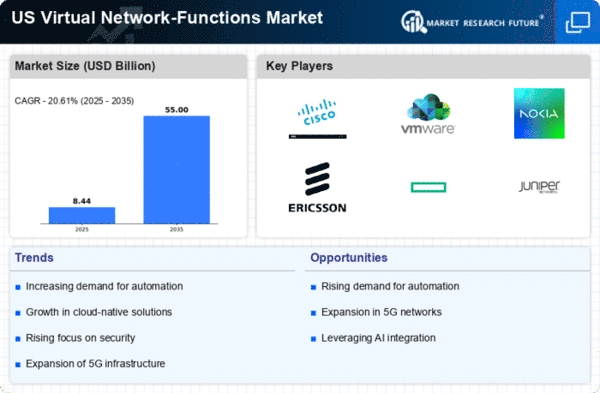

The virtual network-functions market is experiencing a notable surge in demand for enhanced network scalability. As organizations increasingly migrate to digital platforms, the need for flexible and scalable network solutions becomes paramount. This trend is particularly evident in sectors such as telecommunications and IT services, where the ability to rapidly scale network resources can lead to improved operational efficiency. According to recent data, the market for virtual network functions is projected to grow at a CAGR of approximately 25% over the next five years. This growth is driven by the necessity for businesses to adapt to fluctuating workloads and customer demands, thereby reinforcing the importance of scalability in the virtual network-functions market.

Cost Efficiency and Operational Savings

Cost efficiency remains a critical driver in the virtual network-functions market. Organizations are increasingly seeking ways to reduce operational costs while maintaining high service quality. Virtual network functions enable businesses to consolidate hardware and streamline operations, leading to significant savings. For instance, companies can reduce capital expenditures by up to 30% through the adoption of virtualized network solutions. This financial incentive is compelling, particularly for small to medium-sized enterprises that may have limited budgets. As a result, the drive for cost efficiency is likely to continue shaping the virtual network-functions market, encouraging further adoption of these technologies across various industries.