Cost Efficiency and Operational Savings

Cost efficiency remains a pivotal driver in the virtual cpe market, particularly for UK businesses looking to optimize their operational expenditures. The transition from traditional hardware to virtual CPE solutions allows organizations to significantly reduce capital expenditures associated with physical devices. By leveraging virtual solutions, companies can achieve operational savings of up to 30%, which is particularly appealing in a competitive market. The virtual cpe market is thus witnessing increased interest from enterprises aiming to streamline their IT budgets while maintaining high service quality. This focus on cost efficiency is likely to propel further adoption of virtual CPE technologies across various sectors.

Regulatory Compliance and Data Protection

In the UK, regulatory compliance and data protection are becoming increasingly critical for businesses, influencing the virtual cpe market. The introduction of stringent regulations, such as the General Data Protection Regulation (GDPR), has compelled organizations to adopt solutions that ensure data security and compliance. As a result, the virtual cpe market is witnessing a rise in demand for services that offer enhanced security features and compliance capabilities. Companies are investing in virtual CPE solutions that not only meet regulatory requirements but also provide robust data protection measures. This trend is expected to drive market growth, as businesses prioritize compliance to avoid hefty fines and reputational damage.

Growing Demand for Flexible Networking Solutions

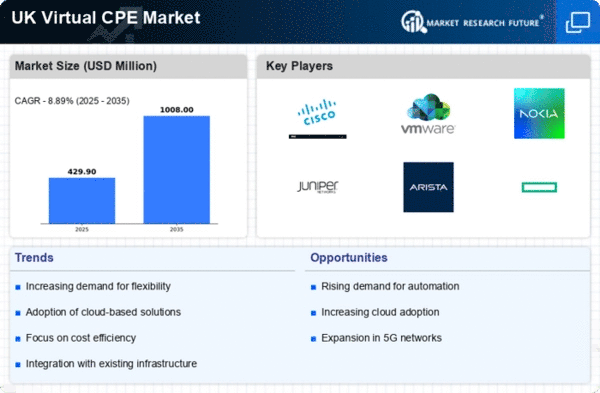

The virtual cpe market is experiencing a notable surge in demand for flexible networking solutions. Businesses in the UK are increasingly seeking to enhance their network capabilities without the constraints of traditional hardware. This shift is driven by the need for agility and scalability in operations. According to recent data, the market for virtual CPE solutions is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of a broader trend where enterprises are prioritizing cost-effective and adaptable networking options. The virtual cpe market is thus positioned to benefit from this evolving landscape, as organizations look to streamline their operations and reduce overhead costs associated with physical equipment.

Advancements in Network Virtualization Technologies

Advancements in network virtualization technologies are playing a crucial role in shaping the virtual cpe market. Innovations in software-defined networking (SDN) and network function virtualization (NFV) are enabling more efficient and flexible network management solutions. These technologies allow businesses in the UK to deploy virtual CPE solutions that can be easily scaled and customized to meet specific needs. The virtual cpe market is benefiting from these advancements, as they provide enhanced performance and reliability. As organizations increasingly recognize the advantages of virtualization, the market is expected to see a robust growth trajectory, driven by the demand for cutting-edge networking solutions.

Shift Towards Remote Work and Digital Transformation

The ongoing shift towards remote work and digital transformation is significantly impacting the virtual cpe market. As organizations in the UK adapt to new working environments, there is a growing need for reliable and efficient networking solutions that support remote operations. The virtual cpe market is responding to this demand by offering solutions that facilitate seamless connectivity and collaboration among remote teams. Recent statistics indicate that nearly 60% of UK businesses have adopted some form of remote work, further driving the need for virtual CPE solutions. This trend suggests that the market will continue to expand as companies seek to enhance their digital infrastructure to support a distributed workforce.