Growing Focus on Cost Efficiency

Cost efficiency remains a critical driver for the virtual cpe market in Japan. Organizations are increasingly seeking solutions that reduce operational costs while maintaining high service quality. Virtual cpe technologies offer a compelling value proposition by minimizing the need for physical hardware and associated maintenance expenses. Market analysis indicates that businesses can achieve cost savings of up to 30% by transitioning to virtual cpe solutions. This financial incentive is particularly appealing in a competitive landscape where companies strive to optimize their budgets. Consequently, the virtual cpe market is likely to witness a robust increase in adoption as firms prioritize cost-effective solutions that align with their financial objectives.

Advancements in Network Infrastructure

The evolution of network infrastructure in Japan plays a pivotal role in shaping the virtual cpe market. With the rollout of 5G technology and enhanced broadband capabilities, the demand for advanced virtual cpe solutions is expected to rise. These advancements enable faster data transmission and improved connectivity, which are essential for modern business operations. The virtual cpe market is poised to capitalize on these developments, as organizations seek to leverage high-speed networks for their virtual solutions. Furthermore, the integration of next-generation technologies, such as edge computing, is likely to enhance the functionality of virtual cpe offerings, thereby attracting more users and driving market growth.

Rising Demand for Remote Work Solutions

The virtual cpe market in Japan experiences a notable surge in demand due to the increasing prevalence of remote work solutions. As organizations adapt to flexible work environments, the need for reliable and efficient virtual customer premises equipment becomes paramount. This shift is reflected in the market data, indicating a projected growth rate of approximately 15% annually through 2026. Companies are investing in virtual cpe technologies to ensure seamless connectivity and collaboration among remote teams. The virtual cpe market is thus positioned to benefit from this trend, as businesses seek to enhance productivity while maintaining operational efficiency. Furthermore, the integration of advanced features in virtual cpe solutions, such as enhanced bandwidth management and improved user experience, is likely to further drive adoption in this evolving work landscape.

Government Initiatives Supporting Digital Transformation

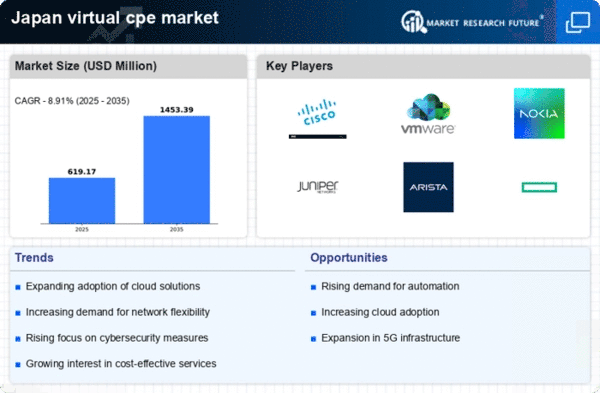

In Japan, government initiatives aimed at promoting digital transformation significantly impact the virtual cpe market. The government has launched various programs to encourage businesses to adopt digital technologies, which includes the deployment of virtual cpe solutions. These initiatives are designed to enhance the overall digital infrastructure, thereby facilitating smoother transitions to virtual environments. As a result, the virtual cpe market is likely to see increased investments, with estimates suggesting a potential market size expansion of over $1 billion by 2027. This supportive regulatory environment not only fosters innovation but also encourages collaboration between public and private sectors, ultimately driving the adoption of virtual cpe technologies across various industries.

Increased Emphasis on Compliance and Regulatory Standards

In Japan, the virtual cpe market is increasingly influenced by the need for compliance with stringent regulatory standards. Organizations are required to adhere to various data protection and privacy regulations, which necessitate the implementation of secure virtual cpe solutions. This emphasis on compliance is driving businesses to invest in technologies that not only meet regulatory requirements but also enhance their overall security posture. The virtual cpe market is thus witnessing a shift towards solutions that offer robust security features, with market projections indicating a potential growth of 20% in this segment by 2026. As companies prioritize compliance, the demand for virtual cpe solutions that align with regulatory frameworks is likely to continue to rise.