Advancements in Technology and Features

Technological advancements play a pivotal role in shaping the tablet pc market. Innovations such as improved processing power, enhanced battery life, and high-resolution displays contribute to the appeal of tablets among consumers. The introduction of 5G connectivity has also transformed user experiences, enabling faster internet access and seamless streaming capabilities. In the UK, the tablet market has witnessed a 20% increase in sales attributed to these technological enhancements. As manufacturers continue to innovate, the tablet pc market is poised for further growth, with consumers increasingly drawn to devices that offer superior performance and functionality.

Growing Demand for Remote Work Solutions

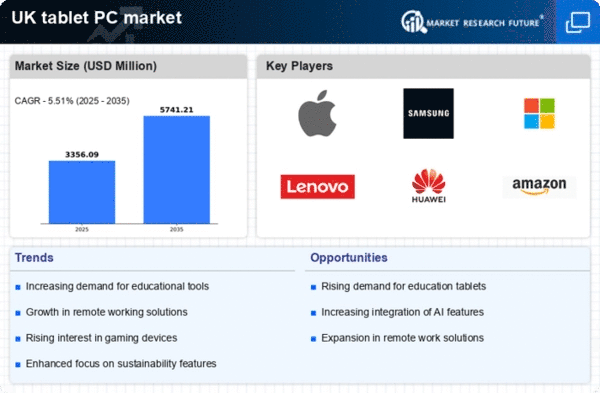

The tablet pc market in the UK experiences a notable surge in demand due to the increasing prevalence of remote work. As businesses adapt to flexible working arrangements, employees seek portable and efficient devices that facilitate productivity. Tablets, with their lightweight design and robust applications, serve as ideal tools for remote collaboration. Recent data indicates that the tablet segment has seen a growth rate of approximately 15% in the last year, driven by the need for devices that support video conferencing and document sharing. This trend suggests that the tablet pc market is likely to continue expanding as more companies embrace hybrid work models, further solidifying the role of tablets in everyday business operations.

Rising Popularity of Digital Learning Tools

The tablet pc market benefits significantly from the rising popularity of digital learning tools in educational settings. Schools and universities in the UK are increasingly integrating tablets into their curricula, recognizing their potential to enhance learning experiences. The market data indicates that educational institutions have invested over £500 million in tablet technology over the past year, reflecting a commitment to modernizing education. This trend suggests that the tablet pc market will continue to thrive as educational stakeholders prioritize digital solutions that foster engagement and accessibility for students.

Increased Consumer Preference for Portability

Consumer preferences are shifting towards portable devices, which is a key driver for the tablet pc market. The compact nature of tablets allows users to easily carry them for various activities, from work to leisure. In the UK, surveys indicate that 70% of consumers prioritize portability when selecting electronic devices. This inclination towards lightweight and versatile gadgets suggests that the tablet pc market is likely to see sustained growth as manufacturers respond to consumer demands for convenience and mobility.

Expansion of Content and Application Ecosystems

The expansion of content and application ecosystems significantly influences the tablet pc market. As more applications become available for tablets, ranging from productivity tools to entertainment platforms, the appeal of these devices increases. In the UK, the app market for tablets has grown by 25% in the last year, indicating a robust demand for diverse functionalities. This trend suggests that the tablet pc market will continue to evolve, as developers create innovative applications that cater to various user needs, enhancing the overall value proposition of tablets.