Rising Demand for Precision Surgery

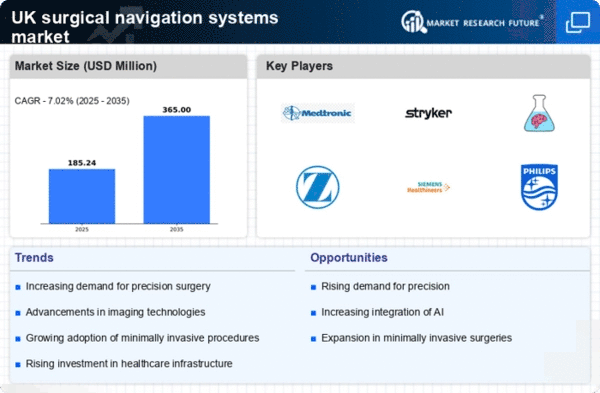

The surgical navigation-systems market is experiencing a notable increase in demand for precision surgery. Surgeons and healthcare providers are increasingly recognising the benefits of enhanced accuracy in surgical procedures. This trend is driven by the growing awareness of the advantages of minimally invasive techniques, which often result in reduced recovery times and improved patient outcomes. In the UK, the market for surgical navigation systems is projected to grow at a CAGR of approximately 8% over the next five years. This growth is likely to be supported by advancements in imaging technologies and the integration of artificial intelligence, which further enhance the capabilities of navigation systems. As a result, the surgical navigation-systems market is becoming an essential component in modern surgical practices, aligning with the broader shift towards precision medicine.

Growing Prevalence of Chronic Diseases

The rising prevalence of chronic diseases in the UK is a critical factor influencing the surgical navigation-systems market. Conditions such as obesity, diabetes, and cardiovascular diseases are becoming increasingly common, necessitating more surgical interventions. According to recent statistics, approximately 30% of the UK population is classified as obese, which significantly raises the demand for surgical procedures like bariatric surgery. This trend is likely to drive the adoption of surgical navigation systems, as they offer enhanced precision and safety during complex surgeries. Additionally, the surgical navigation-systems market is expected to benefit from the increasing number of surgical procedures performed annually, as healthcare providers seek to improve patient outcomes and reduce complications. The integration of navigation systems into surgical practices may thus become a standard approach in managing chronic diseases.

Focus on Training and Education for Surgeons

The surgical navigation-systems market is also influenced by the growing emphasis on training and education for surgeons. As surgical techniques become more complex, there is a pressing need for healthcare professionals to be well-versed in the use of advanced navigation systems. In the UK, medical institutions are increasingly incorporating simulation-based training programs to equip surgeons with the necessary skills to utilise these technologies effectively. This focus on education is likely to enhance the adoption of surgical navigation systems, as trained professionals are more confident in their capabilities. Moreover, ongoing professional development and certification programs are being established to ensure that surgeons remain updated on the latest advancements in surgical navigation. Consequently, the surgical navigation-systems market is expected to benefit from a well-trained workforce that can leverage these technologies to improve patient care.

Technological Integration and Interoperability

The surgical navigation-systems market is being propelled by the integration of advanced technologies and the need for interoperability among medical devices. As healthcare systems evolve, there is a growing emphasis on creating seamless connections between various surgical tools and navigation systems. This integration allows for real-time data sharing and improved decision-making during surgical procedures. In the UK, hospitals are increasingly adopting electronic health records (EHR) and other digital solutions, which can enhance the functionality of surgical navigation systems. The ability to access patient data and imaging in real-time can significantly improve surgical outcomes. Furthermore, the surgical navigation-systems market is likely to see increased collaboration between technology providers and healthcare institutions, fostering innovation and enhancing the overall efficiency of surgical practices.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure in the UK is a significant driver for the surgical navigation-systems market. The government and private sector are allocating substantial funds to upgrade medical facilities and incorporate advanced technologies. This investment is aimed at improving surgical outcomes and patient care. For instance, the UK government has committed to increasing healthcare spending, which is expected to reach £200 billion by 2025. Such financial support is likely to facilitate the adoption of surgical navigation systems, as hospitals seek to enhance their surgical capabilities. Furthermore, the integration of these systems into existing infrastructure can lead to more efficient surgical workflows, ultimately benefiting both healthcare providers and patients. The surgical navigation-systems market stands to gain from this trend as hospitals strive to remain competitive and provide high-quality care.