Focus on Patient Safety and Quality of Care

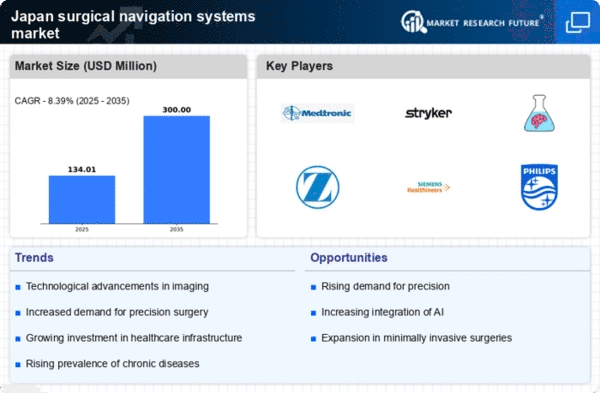

The emphasis on patient safety and quality of care is reshaping the surgical navigation-systems market in Japan. Healthcare providers are increasingly adopting technologies that enhance surgical precision and minimize risks associated with surgical procedures. Regulatory bodies are also advocating for the implementation of advanced navigation systems as part of their quality assurance initiatives. This focus on safety is likely to drive the adoption of surgical navigation systems, as they are proven to reduce complications and improve overall patient outcomes. The market is projected to grow by approximately 8% annually as hospitals prioritize investments in technologies that align with these safety standards.

Increased Funding for Healthcare Technology

In Japan, there is a growing trend of increased funding for healthcare technology, which is positively impacting the surgical navigation-systems market. Government initiatives aimed at modernizing healthcare infrastructure are providing financial support for the acquisition of advanced surgical technologies. This funding is crucial for hospitals and surgical centers looking to upgrade their equipment and improve surgical outcomes. As a result, the surgical navigation-systems market is expected to expand, with investments projected to reach $300 million by 2026. This influx of capital not only facilitates the adoption of innovative technologies but also enhances the overall quality of surgical care in the country.

Aging Population and Increased Surgical Needs

Japan's aging population is a critical driver of the surgical navigation-systems market. As the demographic shifts towards an older age group, there is a corresponding rise in the prevalence of chronic diseases that often require surgical intervention. The Japanese government has recognized this trend and is investing in healthcare solutions that cater to the needs of the elderly. This demographic shift is expected to lead to an increase in surgical procedures, thereby driving demand for advanced surgical navigation systems. It is estimated that by 2030, the number of surgeries performed annually in Japan could increase by 15%, further solidifying the role of surgical navigation systems in enhancing surgical outcomes.

Technological Advancements in Imaging Systems

Technological advancements in imaging systems are significantly influencing the surgical navigation-systems market in Japan. Innovations such as 3D imaging, augmented reality, and real-time tracking are enhancing the capabilities of surgical navigation systems. These technologies allow for improved visualization of anatomical structures, which is crucial for complex surgical procedures. The integration of advanced imaging modalities is expected to increase the accuracy of surgical interventions, thereby reducing the likelihood of errors. As hospitals and surgical centers invest in these cutting-edge technologies, the surgical navigation-systems market is likely to witness substantial growth, with an estimated increase in market value reaching $500 million by 2027.

Rising Demand for Minimally Invasive Procedures

The surgical navigation-systems market in Japan is experiencing a notable increase in demand for minimally invasive surgical procedures. This trend is driven by the growing preference among patients for surgeries that promise reduced recovery times and lower risk of complications. As a result, healthcare providers are increasingly adopting advanced surgical navigation systems to enhance precision and accuracy during these procedures. According to recent data, the market for minimally invasive surgeries is projected to grow at a CAGR of approximately 10% over the next five years. This shift not only improves patient outcomes but also aligns with the broader goals of healthcare efficiency and cost reduction, thereby propelling the surgical navigation-systems market forward.