Government Initiatives and Funding

Government initiatives and funding play a significant role in shaping the robot operating-system market. The UK government has been actively promoting the adoption of robotics through various funding programs and initiatives aimed at enhancing innovation and competitiveness. For instance, the UK Robotics and Autonomous Systems (UK-RAS) Network has been established to support research and development in robotics. Such initiatives are likely to encourage businesses to invest in robotic technologies, thereby increasing the demand for advanced operating systems. The allocation of public funds for research in robotics is expected to reach £200 million by 2026, further stimulating growth in the robot operating-system market. This supportive environment indicates a promising future for the industry, as it fosters collaboration between academia and industry.

Technological Advancements in Robotics

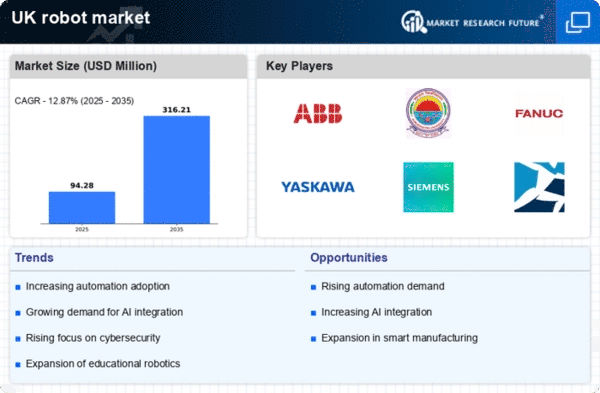

The rapid pace of technological advancements in robotics is a key driver for the robot operating-system market. Innovations in artificial intelligence, machine learning, and sensor technologies are enhancing the capabilities of robots, making them more efficient and versatile. In the UK, the integration of advanced robotics in various sectors, including manufacturing and logistics, is expected to boost the demand for sophisticated operating systems. The market is projected to grow at a CAGR of approximately 15% over the next five years, indicating a strong upward trend. As companies seek to improve productivity and reduce operational costs, the reliance on advanced robot operating systems becomes increasingly critical. This trend suggests that the robot operating-system market will continue to evolve, driven by the need for more intelligent and adaptable robotic solutions.

Growing Awareness of Robotics in Education

The growing awareness of robotics in education is emerging as a notable driver for the robot operating-system market. Educational institutions in the UK are increasingly incorporating robotics into their curricula, fostering interest among students in STEM fields. This trend is likely to create a new generation of engineers and developers who are well-versed in robotic technologies and operating systems. As educational programs expand, the demand for educational robots and their corresponding operating systems is expected to rise. This shift not only supports the growth of the robot operating-system market but also ensures a skilled workforce for the future. The emphasis on robotics education suggests a long-term commitment to advancing the industry, ultimately benefiting the broader economy.

Increased Focus on Research and Development

An increased focus on research and development (R&D) within the robotics sector is propelling the robot operating-system market forward. UK-based companies and research institutions are investing heavily in R&D to create innovative solutions that address specific industry challenges. This emphasis on R&D is likely to lead to the development of more sophisticated operating systems that can support a wider range of robotic applications. The UK government has also recognized the importance of R&D in robotics, with funding initiatives aimed at fostering innovation. As a result, the robot operating-system market is expected to benefit from a continuous influx of new technologies and solutions, enhancing its overall growth potential. The commitment to R&D indicates a long-term vision for the industry, positioning it for sustained advancement.

Rising Demand for Automation in Various Sectors

The increasing demand for automation across various sectors is a significant driver for the robot operating-system market. Industries such as logistics, agriculture, and construction are increasingly adopting robotic solutions to enhance efficiency and reduce human error. In the UK, the logistics sector alone is projected to invest over £1 billion in automation technologies by 2025. This trend is likely to create a substantial market for robot operating systems that can manage and control these automated systems effectively. As businesses strive to remain competitive, the integration of robotics into their operations is becoming essential. Consequently, the robot operating-system market is expected to experience robust growth, driven by the need for seamless automation solutions.