Rising Labor Costs

Rising labor costs in Canada are driving businesses to seek automation solutions, thereby impacting the robot operating-system market. As wages continue to increase, companies are exploring ways to maintain profitability while ensuring operational efficiency. The integration of robots into workflows presents a viable solution to mitigate these rising costs. In sectors such as manufacturing and logistics, where labor-intensive tasks are prevalent, the adoption of robotic systems is becoming more attractive. This shift is likely to create a heightened demand for sophisticated robot operating systems that can manage and optimize robotic operations. With labor costs projected to rise by 5% annually, the urgency for automation solutions is expected to propel the growth of the robot operating-system market, as businesses strive to remain competitive in an evolving economic landscape.

Growing Demand for Automation

The increasing demand for automation in various industries is significantly impacting the robot operating-system market. In Canada, businesses are increasingly recognizing the benefits of automating repetitive tasks to enhance efficiency and reduce labor costs. This trend is particularly evident in sectors such as manufacturing, where automation can lead to improved production rates and quality control. According to recent statistics, the automation market in Canada is expected to grow at a CAGR of 10% over the next five years. As companies invest in robotic solutions, the need for robust operating systems that can seamlessly integrate with existing infrastructure becomes critical. This growing demand for automation not only drives the robot operating-system market but also encourages innovation in software development, leading to more sophisticated and user-friendly systems.

Supportive Government Policies

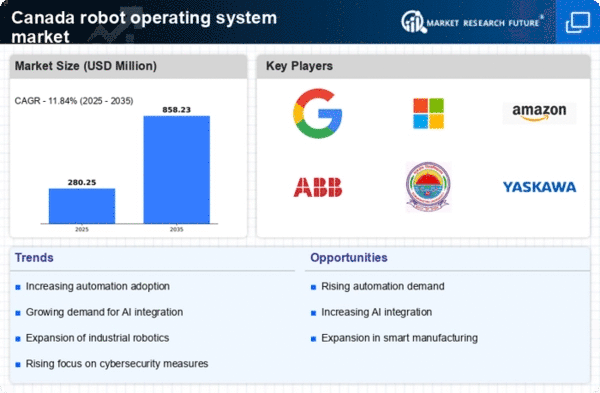

Government policies in Canada are playing a crucial role in shaping the robot operating-system market. Initiatives aimed at promoting technological innovation and automation are encouraging businesses to adopt robotic solutions. The Canadian government has introduced various funding programs and tax incentives to support research and development in robotics. These policies are likely to foster a favorable environment for the growth of the robot operating-system market. Furthermore, the government's commitment to enhancing the country's technological infrastructure may lead to increased investments in robotics. As a result, companies are more inclined to invest in advanced operating systems that can optimize robot performance. This supportive regulatory framework is expected to contribute to a projected market growth rate of 12% annually, reflecting the increasing integration of robotics in various sectors.

Technological Advancements in Robotics

The rapid evolution of robotics technology is a primary driver for the robot operating-system market. In Canada, advancements in sensors, machine learning, and artificial intelligence are enhancing the capabilities of robots, making them more efficient and versatile. This technological progress is likely to lead to increased adoption across various sectors, including manufacturing, healthcare, and logistics. As companies seek to improve productivity and reduce operational costs, the demand for sophisticated robot operating systems that can manage these advanced robots is expected to rise. The Canadian government has also been supportive of research and development initiatives, which may further stimulate growth in the robot operating-system market. With an estimated market value projected to reach $1 billion by 2027, the implications of these advancements are profound, potentially reshaping industries and creating new opportunities for innovation.

Increased Focus on Research and Development

The emphasis on research and development (R&D) within Canada is a significant driver for the robot operating-system market. As industries recognize the potential of robotics, there is a concerted effort to innovate and improve existing technologies. Canadian universities and research institutions are actively collaborating with businesses to develop cutting-edge robotic solutions. This focus on R&D is likely to lead to the creation of more advanced operating systems that can support a wider range of applications. Furthermore, increased investment in R&D is expected to enhance the capabilities of robots, making them more adaptable and efficient. With the Canadian government allocating substantial funding for technological innovation, the robot operating-system market is poised for growth, potentially reaching a valuation of $800 million by 2026.