Advancements in Surgical Techniques

Innovations in surgical techniques are significantly influencing the orthopedic biomaterial market. Minimally invasive procedures are gaining traction, allowing for quicker recovery and reduced hospital stays. The adoption of these techniques often requires specialized biomaterials that can support the unique demands of such surgeries. For instance, the use of bioactive materials that promote bone regeneration is becoming increasingly prevalent. The market for these advanced biomaterials is projected to grow, with estimates suggesting a compound annual growth rate (CAGR) of around 7% over the next few years. This trend indicates a shift towards more efficient surgical practices, further propelling the orthopedic biomaterial market.

Increasing Awareness of Biomaterials

There is a growing awareness among healthcare professionals and patients regarding the benefits of advanced biomaterials in orthopedic applications. Educational initiatives and professional training programs are enhancing knowledge about the advantages of using biomaterials, such as improved healing rates and reduced complications. This heightened awareness is likely to lead to increased adoption of these materials in clinical settings. As more practitioners recognize the potential of biomaterials, the orthopedic biomaterial market is expected to expand, with a corresponding increase in demand for innovative products that meet the evolving needs of patients.

Rising Incidence of Orthopedic Disorders

The orthopedic biomaterial market is experiencing growth due to the increasing prevalence of orthopedic disorders in the UK. Conditions such as osteoarthritis and fractures are becoming more common, particularly among the aging population. According to recent data, approximately 8 million people in the UK are affected by osteoarthritis, leading to a higher demand for orthopedic interventions. This surge in orthopedic procedures necessitates the use of advanced biomaterials, which are essential for effective treatment and recovery. As the population ages, the orthopedic biomaterial market is likely to expand, driven by the need for innovative solutions that enhance patient outcomes and reduce recovery times.

Growing Investment in Research and Development

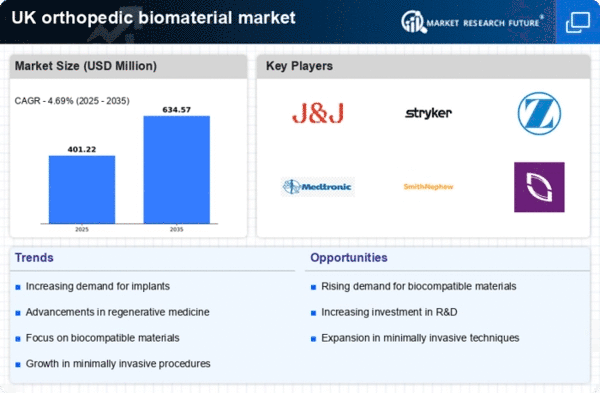

Investment in research and development (R&D) within the orthopedic biomaterial market is on the rise, driven by the need for innovative solutions. Companies are focusing on developing new materials that offer enhanced biocompatibility and mechanical properties. The UK government has been supportive of initiatives aimed at fostering innovation in healthcare, which includes funding for biomaterial research. This investment is crucial for the development of next-generation orthopedic implants and devices. As a result, the market is expected to witness a surge in new product launches, which could potentially increase market share and drive competition among key players.

Regulatory Support for Innovative Biomaterials

The regulatory landscape for the orthopedic biomaterial market is evolving, with authorities in the UK providing support for the introduction of innovative materials. Streamlined approval processes for new biomaterials are encouraging manufacturers to invest in the development of cutting-edge products. This regulatory support is crucial for bringing new technologies to market more efficiently, thereby enhancing competition and innovation. As a result, the orthopedic biomaterial market is likely to benefit from a wider array of products, catering to diverse patient needs and preferences, ultimately driving market growth.