Growing Aging Population

The orthopedic biomaterial market is experiencing growth due to the increasing aging population in the United States. As individuals age, they often face musculoskeletal disorders, leading to a higher demand for orthopedic interventions. According to the U.S. Census Bureau, the population aged 65 and older is projected to reach 80 million by 2040, which represents a significant market opportunity. This demographic shift necessitates the development and utilization of advanced orthopedic biomaterials to address age-related conditions such as osteoarthritis and fractures. The orthopedic biomaterial market is thus poised to expand as healthcare providers seek innovative solutions to improve patient outcomes and enhance the quality of life for older adults.

Rising Incidence of Sports Injuries

The orthopedic biomaterial market is significantly influenced by the rising incidence of sports injuries across various age groups. With an increasing number of individuals participating in sports and physical activities, the demand for orthopedic solutions is on the rise. The American Academy of Orthopaedic Surgeons reports that approximately 3.5 million children under 14 years receive medical treatment for sports injuries annually. This trend necessitates the use of advanced orthopedic biomaterials for effective treatment and rehabilitation. The orthopedic biomaterial market is thus likely to benefit from the growing need for innovative materials that can provide better support and faster recovery for athletes and active individuals.

Technological Innovations in Biomaterials

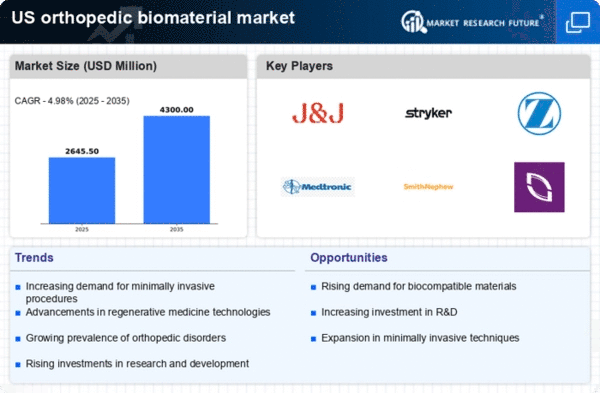

Technological advancements in biomaterials are driving the orthopedic biomaterial market forward. Innovations such as the development of smart biomaterials that can respond to physiological changes are gaining traction. These materials can potentially enhance healing processes and improve the integration of implants with bone tissue. The orthopedic biomaterial market is witnessing a surge in research and development activities, with investments in new material formulations and processing techniques. For instance, the introduction of bioactive glasses and composites is expected to enhance the performance of orthopedic implants. As a result, the market is likely to see a compound annual growth rate (CAGR) of around 7% over the next few years, reflecting the impact of these technological advancements.

Growing Awareness of Preventive Healthcare

The orthopedic biomaterial market is also being driven by a growing awareness of preventive healthcare among the U.S. population. As individuals become more health-conscious, there is an increasing emphasis on early intervention and the use of advanced materials to prevent injuries and degenerative conditions. This trend is leading to a higher demand for orthopedic biomaterials that can be used in preventive measures, such as joint preservation techniques and minimally invasive surgeries. The orthopedic biomaterial market is likely to expand as healthcare providers focus on educating patients about the benefits of using advanced biomaterials for long-term health outcomes.

Increased Investment in Healthcare Infrastructure

The orthopedic biomaterial market is benefiting from increased investment in healthcare infrastructure in the United States. Government initiatives and private sector investments are aimed at enhancing healthcare facilities and expanding access to advanced medical technologies. This trend is particularly relevant for orthopedic services, where the demand for high-quality biomaterials is rising. The orthopedic biomaterial market is likely to see a boost as hospitals and clinics upgrade their equipment and adopt new technologies. According to the American Hospital Association, healthcare spending is projected to grow at an annual rate of 5.4% through 2028, which will likely support the growth of the orthopedic biomaterial market.