Emergence of Big Data Analytics

The open database-connectivity market is significantly influenced by the emergence of big data analytics in the UK. As organizations increasingly rely on data-driven decision-making, the need for robust data connectivity solutions becomes paramount. The ability to analyze vast amounts of data from diverse sources requires efficient database connectivity to ensure timely insights. The UK big data market is expected to reach £2 billion by 2026, indicating a strong demand for tools that can integrate and manage data effectively. Consequently, the open database-connectivity market is poised to benefit from this trend, as businesses seek solutions that enhance their analytical capabilities.

Rising Adoption of Cloud Technologies

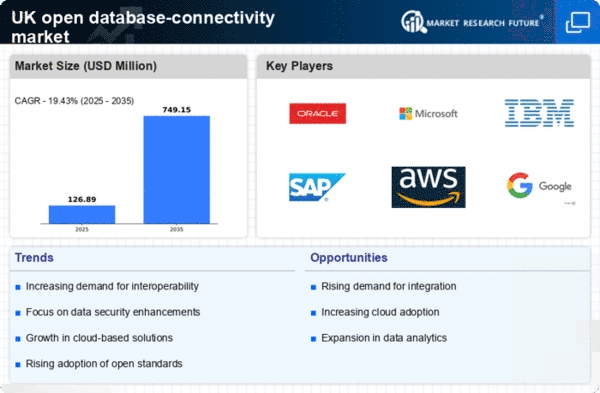

The open database-connectivity market is experiencing a notable surge due to the increasing adoption of cloud technologies across various sectors in the UK. Businesses are migrating their operations to cloud platforms, which necessitates seamless data integration and connectivity. This shift is driven by the need for scalability, flexibility, and cost-effectiveness. According to recent data, the cloud services market in the UK is projected to grow at a CAGR of 20% over the next five years. As organizations seek to leverage cloud capabilities, the demand for open database-connectivity solutions that facilitate efficient data access and management is likely to rise, thereby propelling the market forward.

Increased Focus on Real-Time Data Access

The open database-connectivity market is witnessing an increased focus on real-time data access, driven by the need for timely information in decision-making processes. In the UK, businesses are increasingly adopting technologies that enable instant data retrieval and analysis. This trend is particularly evident in sectors such as retail and finance, where real-time insights can significantly impact customer engagement and operational efficiency. The demand for solutions that facilitate real-time data connectivity is expected to grow, as organizations seek to enhance their responsiveness to market changes. This shift is likely to create new opportunities within the open database-connectivity market.

Growing Emphasis on Data Interoperability

In the open database-connectivity market, the growing emphasis on data interoperability is a critical driver. Organizations in the UK are increasingly recognizing the importance of integrating disparate data sources to create a unified view of information. This trend is particularly relevant in sectors such as healthcare and finance, where data silos can hinder operational efficiency. The UK government has also initiated various programs to promote data sharing and interoperability, further fueling the demand for open database-connectivity solutions. As businesses strive to enhance collaboration and streamline processes, the market for these connectivity solutions is expected to expand..

Advancements in Data Security Technologies

The open database-connectivity market is also being shaped by advancements in data security technologies. As organizations in the UK become more aware of the risks associated with data breaches and cyber threats, there is a growing demand for connectivity solutions that prioritize security. Innovations in encryption, access controls, and authentication methods are becoming essential features of open database-connectivity solutions. The UK cybersecurity market is projected to reach £8 billion by 2025, indicating a robust investment in security measures. This focus on data protection is likely to drive the adoption of secure open database-connectivity solutions, thereby influencing market dynamics.