Rising Data Volume and Complexity

The open database-connectivity market in Canada is experiencing a surge due to the increasing volume and complexity of data generated by businesses. As organizations adopt advanced technologies, such as IoT and big data analytics, the need for efficient data integration solutions becomes paramount. In 2025, it is estimated that data generation in Canada will reach approximately 2.5 zettabytes, necessitating robust connectivity solutions. This trend drives demand for open database-connectivity tools that can seamlessly integrate diverse data sources, enabling organizations to derive actionable insights. Consequently, businesses are investing in these solutions to enhance operational efficiency and decision-making capabilities, thereby propelling growth in the open database-connectivity market.

Government Initiatives and Support

Government initiatives aimed at fostering digital transformation in Canada significantly impact the open database-connectivity market. Programs promoting data sharing and interoperability among public sector organizations encourage the adoption of open database-connectivity solutions. For instance, the Canadian government's Digital Government Strategy emphasizes the importance of data accessibility and integration, which aligns with the objectives of the open database-connectivity market. Furthermore, funding opportunities for technology innovation and research in data management are likely to stimulate market growth. As public sector entities increasingly seek to modernize their data infrastructure, the demand for open database-connectivity solutions is expected to rise, creating a favorable environment for market expansion.

Shift Towards Hybrid IT Environments

The transition towards hybrid IT environments is a notable driver of the open database-connectivity market in Canada. Organizations are increasingly adopting a mix of on-premises and cloud-based solutions to optimize their IT infrastructure. This shift necessitates effective data integration tools that can bridge the gap between disparate systems. As businesses seek to leverage the benefits of both environments, the demand for open database-connectivity solutions that facilitate seamless data flow is likely to increase. In 2025, it is anticipated that over 60% of Canadian enterprises will operate in hybrid environments, further underscoring the need for robust connectivity solutions to support their data management strategies.

Growing Emphasis on Real-Time Data Access

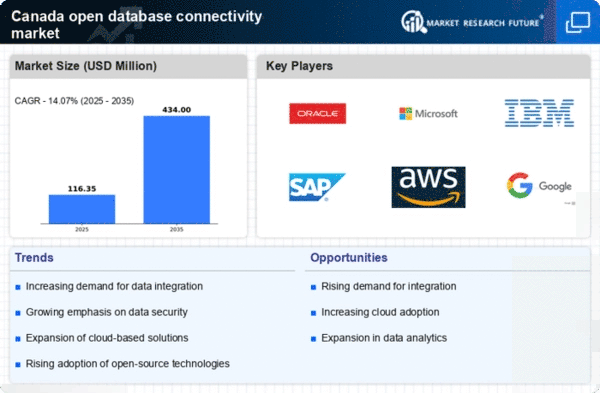

In the current landscape, the emphasis on real-time data access is reshaping the open database-connectivity market in Canada. Organizations are increasingly recognizing the value of timely data for informed decision-making. As a result, there is a growing demand for connectivity solutions that facilitate real-time data integration across various platforms. This trend is particularly evident in sectors such as finance and healthcare, where timely access to data can significantly impact outcomes. The market is projected to grow at a CAGR of 12% from 2025 to 2030, driven by the need for instantaneous data availability. Consequently, businesses are investing in open database-connectivity tools to enhance their operational agility and responsiveness.

Increased Focus on Data Analytics and Business Intelligence

The growing focus on data analytics and business intelligence is significantly influencing the open database-connectivity market in Canada. Organizations are increasingly leveraging data-driven insights to enhance their competitive edge. This trend drives the demand for connectivity solutions that enable efficient data integration from various sources, facilitating comprehensive analytics. In 2025, it is projected that the business intelligence market in Canada will reach $3 billion, highlighting the importance of effective data connectivity. As companies invest in analytics tools, the need for open database-connectivity solutions that support data aggregation and visualization is expected to rise, thereby propelling market growth.