Growing Prevalence of Chronic Diseases

The rising incidence of chronic diseases in the UK is a significant driver for the live cell-encapsulation market. As healthcare providers seek more effective treatment options, the demand for innovative therapies that can deliver sustained therapeutic effects is increasing. Chronic conditions such as diabetes and cancer require advanced treatment modalities, and live cell-encapsulation technologies offer promising solutions. In 2025, it is estimated that chronic diseases will account for over 70% of healthcare expenditures in the UK, highlighting the urgent need for effective therapeutic interventions. This growing prevalence is likely to propel the live cell-encapsulation market forward, as healthcare systems look for ways to improve patient outcomes and reduce long-term costs.

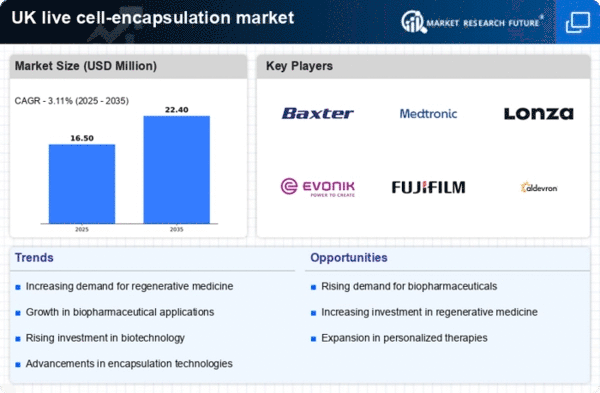

Increasing Investment in Biotechnology

The live cell-encapsulation market is experiencing a surge in investment from both public and private sectors in the UK. This influx of capital is primarily directed towards research and development initiatives aimed at enhancing the efficacy of biopharmaceuticals. In 2025, the UK government allocated approximately £500 million to biotechnology research, which is expected to bolster the live cell-encapsulation market. This financial support is likely to facilitate the development of innovative encapsulation techniques, thereby improving the delivery and stability of therapeutic cells. Furthermore, as the demand for advanced biopharmaceuticals rises, the live cell-encapsulation market is poised to benefit from increased funding, which may lead to the introduction of novel products and technologies that cater to specific medical needs.

Regulatory Support for Advanced Therapies

The regulatory landscape in the UK is becoming increasingly supportive of advanced therapeutic modalities, including those utilizing live cell-encapsulation technologies. The Medicines and Healthcare products Regulatory Agency (MHRA) has streamlined approval processes for innovative therapies, which is likely to encourage more companies to enter the live cell-encapsulation market. This regulatory facilitation is crucial, as it reduces the time and cost associated with bringing new products to market. In 2025, it is anticipated that the number of approved live cell-encapsulation products will increase by 20%, reflecting the positive impact of regulatory support. Such developments not only enhance market growth but also foster a competitive environment that drives innovation within the live cell-encapsulation market.

Rising Awareness of Regenerative Medicine

There is a growing awareness and acceptance of regenerative medicine among healthcare professionals and patients in the UK. This trend is driving interest in live cell-encapsulation technologies, which are integral to the development of regenerative therapies. As more healthcare providers recognize the potential of these technologies to restore function and improve quality of life, the demand for live cell-encapsulation products is expected to rise. In 2025, it is anticipated that the market will see a 25% increase in demand driven by this heightened awareness. This shift in perception is likely to encourage investment in research and development, further propelling the live cell-encapsulation market and fostering collaborations between academia and industry.

Technological Advancements in Cell Encapsulation

Technological innovations are playing a pivotal role in shaping the live cell-encapsulation market. Recent advancements in materials science and engineering have led to the development of more efficient and biocompatible encapsulation materials. These innovations enhance the viability and functionality of encapsulated cells, making them more effective for therapeutic applications. In 2025, it is projected that the introduction of new encapsulation technologies will increase the market's growth rate by approximately 15%. As researchers continue to explore novel materials and techniques, the live cell-encapsulation market is likely to witness a wave of new products that improve treatment efficacy and patient safety, thereby expanding its applications across various therapeutic areas.