Advancements in Material Science

Advancements in material science are propelling the live cell-encapsulation market forward in Japan. The development of biocompatible and biodegradable materials is enhancing the effectiveness of encapsulation techniques, allowing for improved cell viability and functionality. Researchers are exploring novel polymers and hydrogels that can provide optimal environments for live cells, thereby increasing their therapeutic potential. The Japanese market is witnessing a growing interest in these innovative materials, with several universities and research institutions collaborating with industry to develop cutting-edge solutions. As these advancements continue, the live cell-encapsulation market is likely to expand, driven by the demand for more effective and safer encapsulation methods. This trend indicates a promising future for the integration of advanced materials in live cell technologies.

Regulatory Framework Enhancements

The regulatory landscape for the live cell-encapsulation market in Japan is evolving, with enhancements aimed at facilitating the approval process for new therapies. The Pharmaceuticals and Medical Devices Agency (PMDA) is actively working to streamline regulations, which could significantly impact the market. By reducing the time and complexity associated with bringing new encapsulated therapies to market, these regulatory improvements are likely to encourage innovation and investment in live cell technologies. In 2025, it is anticipated that the approval timelines for live cell-based products will decrease by approximately 20%, fostering a more dynamic market environment. This proactive regulatory approach suggests that the live cell-encapsulation market may experience accelerated growth as companies seek to capitalize on the favorable conditions for product development.

Rising Demand for Advanced Therapeutics

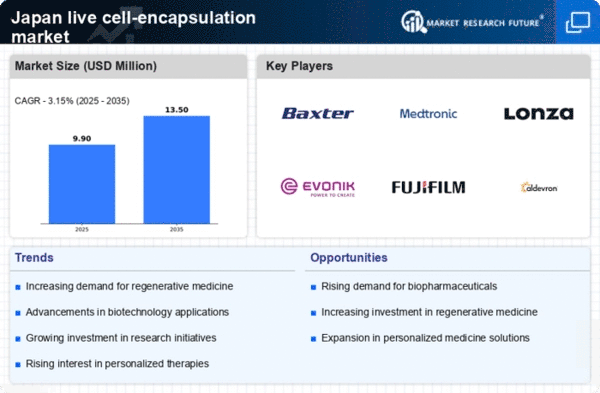

The live cell-encapsulation market in Japan is experiencing a notable surge in demand for advanced therapeutic solutions. This trend is largely driven by the increasing prevalence of chronic diseases, which necessitate innovative treatment options. The Japanese healthcare system is progressively shifting towards personalized medicine, which often requires sophisticated delivery mechanisms for therapeutic agents. Live cell encapsulation offers a promising approach to enhance the efficacy and safety of these treatments. According to recent estimates, the market for advanced therapeutics in Japan is projected to grow at a CAGR of approximately 8% over the next five years, indicating a robust opportunity for the live cell-encapsulation market. As healthcare providers seek to improve patient outcomes, the integration of live cell encapsulation technologies into therapeutic protocols is likely to become more prevalent.

Increased Focus on Regenerative Medicine

The live cell-encapsulation market is significantly influenced by the growing focus on regenerative medicine in Japan. As the population ages, there is an escalating need for therapies that can restore or replace damaged tissues and organs. Live cell encapsulation technologies are being explored as viable solutions for delivering regenerative therapies, such as stem cell treatments. The Japanese government has recognized the potential of regenerative medicine, implementing policies to support research and commercialization in this field. In 2025, the market for regenerative medicine in Japan is anticipated to reach approximately $3 billion, creating substantial opportunities for the live cell-encapsulation market. This alignment with national health priorities suggests that live cell encapsulation could play a pivotal role in addressing the challenges posed by an aging population.

Growing Investment in Biopharmaceutical Research

Investment in biopharmaceutical research is a critical driver for the live cell-encapsulation market in Japan. The country has established itself as a hub for biopharmaceutical innovation, with significant funding directed towards research and development initiatives. In 2025, Japan's biopharmaceutical sector is expected to receive over $5 billion in investments, reflecting a strong commitment to advancing medical technologies. This influx of capital is likely to facilitate the development of novel live cell encapsulation techniques, which can enhance drug delivery and improve therapeutic outcomes. Furthermore, collaborations between academic institutions and industry players are fostering an environment conducive to innovation. As the biopharmaceutical landscape evolves, the live cell-encapsulation market stands to benefit from these advancements, positioning itself as a key player in the future of healthcare.