Expansion of Herbal Product Offerings

The herbal medicine market is witnessing an expansion of product offerings, which appears to cater to diverse consumer preferences. Manufacturers are increasingly innovating and diversifying their product lines to include a variety of herbal supplements, teas, and topical applications. This trend is particularly relevant in the UK, where consumers are seeking tailored solutions for specific health concerns. The herbal medicine market is thus likely to see a proliferation of niche products that address everything from stress relief to digestive health. This diversification not only enhances consumer choice but also encourages trial and adoption of herbal remedies among those who may have been hesitant in the past. As a result, the market is poised for growth as it adapts to the evolving needs of health-conscious consumers.

Regulatory Support for Herbal Products

The herbal medicine market is benefiting from enhanced regulatory support, which appears to bolster consumer confidence in herbal products. In the UK, the Medicines and Healthcare products Regulatory Agency (MHRA) has established guidelines that ensure the safety and efficacy of herbal medicines. This regulatory framework not only protects consumers but also encourages manufacturers to adhere to high standards. As a result, the herbal medicine market is likely to see an influx of new products that meet these stringent requirements. The presence of a robust regulatory environment may also facilitate greater market access for herbal products, potentially leading to increased sales and wider acceptance among healthcare professionals. This supportive landscape is crucial for the sustained growth of the herbal medicine market.

Rising Popularity of Preventive Healthcare

The herbal medicine market is increasingly aligned with the rising popularity of preventive healthcare practices. As individuals become more proactive about their health, there is a growing inclination towards using herbal remedies to prevent illnesses rather than solely treating them. This trend is particularly evident in the UK, where a significant % of the population is adopting lifestyle changes that include the use of herbal supplements. The herbal medicine market is thus likely to benefit from this shift, as consumers seek out products that promote overall well-being and enhance immunity. Additionally, the integration of herbal products into daily health regimens may lead to a more sustained demand, as individuals recognize the long-term benefits of preventive care.

Increasing Demand for Natural Health Solutions

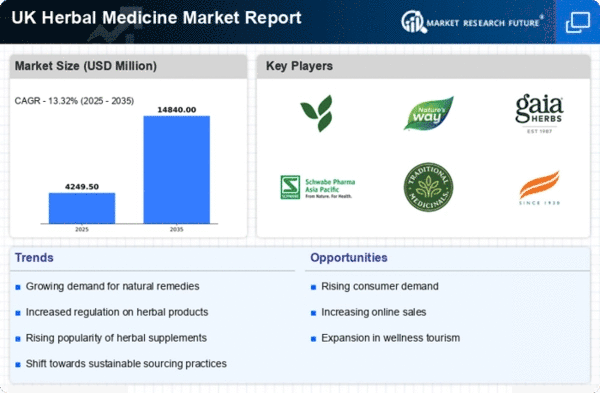

The herbal medicine market is experiencing a notable surge in demand as consumers increasingly seek natural health solutions. This trend is driven by a growing awareness of the potential side effects associated with synthetic pharmaceuticals. In the UK, a significant portion of the population, approximately 38%, has reported using herbal remedies as a primary form of treatment for various ailments. This shift towards natural alternatives is likely to continue, as consumers become more educated about the benefits of herbal products. The herbal medicine market is thus positioned to expand, catering to a demographic that prioritizes holistic health and wellness. Furthermore, the increasing prevalence of chronic diseases may further fuel this demand, as individuals look for complementary therapies to manage their health effectively.

Influence of Social Media and Online Communities

The herbal medicine market is increasingly influenced by social media and online communities, which appear to play a pivotal role in shaping consumer perceptions and preferences. In the UK, platforms such as Instagram and Facebook are becoming vital channels for sharing information about herbal remedies and their benefits. This digital engagement fosters a sense of community among users, who often share personal experiences and recommendations. The herbal medicine market is likely to benefit from this trend, as increased visibility and accessibility can lead to higher consumer interest and sales. Furthermore, the ability to connect with like-minded individuals may encourage more people to explore herbal options, thereby expanding the market reach and enhancing brand loyalty among consumers.