Advancements in EV Technology

Technological advancements in electric vehicles are influencing the UK Electric Vehicle Ev Insurance Market. Innovations such as enhanced battery technology, autonomous driving features, and improved safety systems are becoming commonplace. These advancements not only increase the appeal of EVs but also alter the risk landscape for insurers. For instance, vehicles equipped with advanced driver-assistance systems (ADAS) may experience lower accident rates, potentially leading to reduced insurance premiums. As the technology continues to evolve, insurers are likely to adapt their offerings to reflect these changes, thereby fostering growth within the UK Electric Vehicle Ev Insurance Market. The integration of telematics and data analytics further enables insurers to assess risk more accurately, tailoring policies to individual driving behaviors.

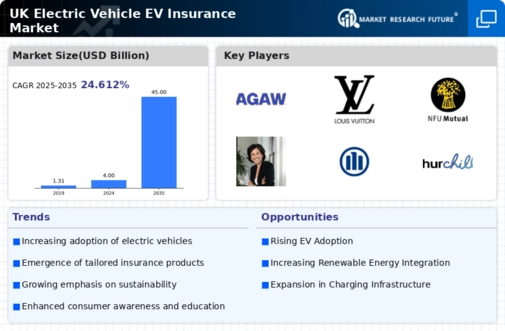

Growing Electric Vehicle Adoption

The UK Electric Vehicle Ev Insurance Market is experiencing a surge in demand due to the increasing adoption of electric vehicles (EVs). As of January 2026, the UK government reports that over 1.5 million electric vehicles are on the roads, reflecting a significant shift in consumer preferences towards sustainable transportation. This growing adoption is likely to drive the need for tailored insurance products that cater specifically to EV owners. Insurers are responding by developing specialized policies that address the unique risks associated with electric vehicles, such as battery damage and charging infrastructure. Consequently, this trend is expected to bolster the UK Electric Vehicle Ev Insurance Market, as more consumers seek coverage that aligns with their eco-friendly choices.

Government Policies and Incentives

The UK government has implemented various policies and incentives to promote electric vehicle adoption, which in turn impacts the UK Electric Vehicle Ev Insurance Market. Initiatives such as grants for EV purchases, tax benefits, and investments in charging infrastructure are designed to encourage consumers to transition to electric vehicles. As of January 2026, the government aims to have at least 300,000 public charging points by 2030, which is expected to enhance the convenience of owning an EV. These supportive measures not only stimulate demand for electric vehicles but also create a corresponding need for specialized insurance products. Insurers are likely to capitalize on these incentives by offering competitive rates and coverage options tailored to the evolving market.

Emerging Competition and Market Dynamics

The UK Electric Vehicle Ev Insurance Market is witnessing an influx of new entrants and innovative business models. Traditional insurers are facing competition from insurtech companies that leverage technology to offer more flexible and customer-centric insurance solutions. This competitive landscape is likely to drive down premiums and improve service offerings for consumers. As of January 2026, several insurtech firms are focusing exclusively on the EV segment, providing tailored coverage options that address the specific needs of electric vehicle owners. This emerging competition may lead to a more dynamic market, where insurers continuously adapt their products to meet evolving consumer demands. Consequently, the UK Electric Vehicle Ev Insurance Market is poised for growth as it embraces innovation and competition.

Environmental Awareness and Sustainability

Increasing environmental awareness among consumers is a driving force behind the UK Electric Vehicle Ev Insurance Market. As public consciousness regarding climate change and pollution grows, more individuals are opting for electric vehicles as a sustainable alternative to traditional combustion engines. This shift is reflected in the rising sales of EVs, which have seen a year-on-year increase of approximately 30% in the UK. Insurers are recognizing this trend and are likely to develop insurance products that not only cover the vehicles but also promote eco-friendly practices. For instance, some insurers may offer discounts for policyholders who engage in sustainable driving behaviors. This alignment with consumer values is expected to enhance the attractiveness of the UK Electric Vehicle Ev Insurance Market.