Market Growth Projections

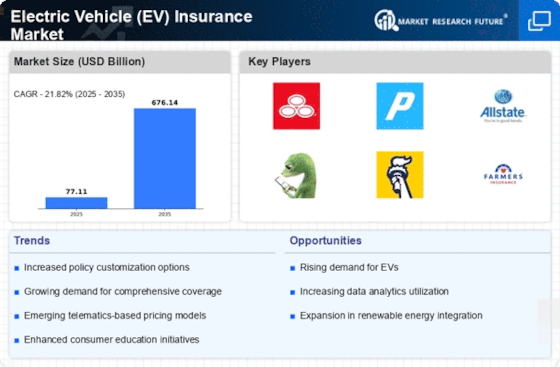

The Global Electric Vehicle (EV) Insurance Market Industry is poised for remarkable growth, with projections indicating a compound annual growth rate (CAGR) of 21.82% from 2025 to 2035. This growth trajectory suggests that the market will expand significantly as the adoption of electric vehicles accelerates and the demand for specialized insurance products increases. By 2035, the market could reach an estimated value of 676.0 USD Billion, reflecting the growing importance of EVs in the automotive landscape. This anticipated growth presents opportunities for insurers to innovate and diversify their offerings, ensuring they meet the evolving needs of a rapidly changing market.

Growing Environmental Awareness

Growing environmental awareness among consumers is a significant driver of the Global Electric Vehicle (EV) Insurance Market Industry. As public concern about climate change and air quality intensifies, more individuals are opting for electric vehicles as a sustainable alternative to traditional combustion engines. This shift in consumer behavior is likely to increase the demand for specialized insurance products that cater to EV owners. Insurers are responding by developing policies that not only cover standard risks but also promote eco-friendly practices. The alignment of insurance offerings with consumer values may enhance customer loyalty and retention, ultimately contributing to the expansion of the EV insurance market.

Emergence of New Insurance Models

The emergence of new insurance models is reshaping the Global Electric Vehicle (EV) Insurance Market Industry. Traditional insurance models are being challenged by innovative approaches such as usage-based insurance and pay-per-mile policies. These models allow consumers to pay premiums based on their actual driving habits, which can be particularly appealing to EV owners who may drive less than average. As the market for electric vehicles continues to grow, insurers are likely to explore these alternative models to attract a broader customer base. This shift may lead to increased competition among insurers, ultimately benefiting consumers through more tailored and cost-effective insurance solutions.

Technological Advancements in EVs

Technological advancements in electric vehicles significantly influence the Global Electric Vehicle (EV) Insurance Market Industry. Innovations such as enhanced battery technology, autonomous driving features, and improved safety systems contribute to the appeal of EVs. These advancements not only enhance vehicle performance but also impact insurance underwriting processes. Insurers are increasingly leveraging data from connected vehicles to assess risk more accurately, which may lead to more competitive pricing models. As the technology continues to evolve, it is likely that insurers will need to adapt their policies to reflect the changing landscape of electric vehicle technology, thereby driving growth in the insurance sector.

Rising Adoption of Electric Vehicles

The increasing adoption of electric vehicles is a primary driver for the Global Electric Vehicle (EV) Insurance Market Industry. As consumers become more environmentally conscious, the demand for EVs continues to rise. In 2024, the market for electric vehicles is projected to reach 77.1 USD Billion, indicating a substantial shift in consumer preferences. This trend is expected to accelerate, with projections suggesting that by 2035, the market could expand to 676.0 USD Billion. This growth in EV adoption necessitates tailored insurance products, thereby creating opportunities for insurers to develop specialized coverage options that address the unique risks associated with electric vehicles.

Government Incentives and Regulations

Government incentives and regulations play a crucial role in shaping the Global Electric Vehicle (EV) Insurance Market Industry. Many governments worldwide are implementing policies to promote the adoption of electric vehicles, including tax credits, rebates, and stricter emissions standards. These initiatives not only encourage consumers to purchase EVs but also create a favorable environment for insurance providers. For instance, countries that offer substantial incentives for EV purchases often see a corresponding increase in insurance demand as more consumers enter the market. As regulations continue to evolve, insurers may need to adjust their offerings to comply with new standards, further driving market growth.