Increased Focus on Consumer Experience

The contactless smart-card market is significantly influenced by the growing emphasis on enhancing consumer experience. Businesses across various sectors are recognizing that providing a seamless and efficient payment process is essential for customer satisfaction. The convenience of contactless payments, which allows for quick transactions without the need for cash or lengthy card swipes, is becoming a key differentiator in competitive markets. Retailers, in particular, are investing in contactless technology to streamline checkout processes and reduce wait times. This focus on consumer experience is expected to drive market growth, with projections indicating that the contactless smart-card market could expand by 18% over the next few years. As companies prioritize customer-centric solutions, the demand for contactless smart cards is likely to rise, further solidifying their position in the payment landscape.

Growing Demand for Contactless Payments

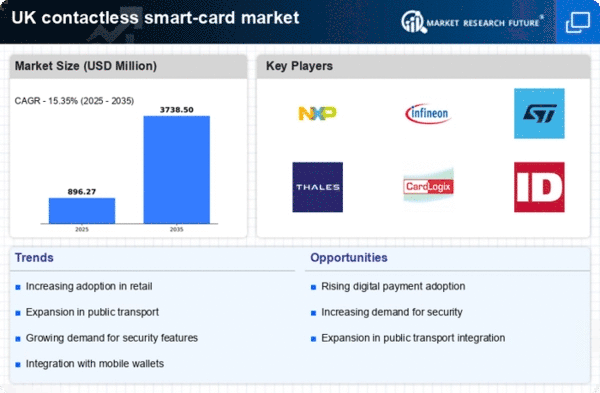

The contactless smart-card market is experiencing a notable surge in demand, particularly within the UK. This trend is largely driven by the increasing consumer preference for quick and efficient payment methods. According to recent data, contactless transactions accounted for approximately 45% of all card payments in the UK, reflecting a significant shift in consumer behavior. The convenience of tapping a card rather than entering a PIN is appealing to many, especially in high-traffic environments such as public transport and retail. As more businesses adopt contactless technology, the market is likely to expand further, with projections indicating a potential growth rate of 15% annually over the next five years. This growing demand is a key driver for the contactless smart-card market, as it aligns with the broader trend towards digitalization in financial transactions.

Expansion of E-commerce and Digital Services

The rapid expansion of e-commerce and digital services is a significant driver for the contactless smart-card market. As online shopping continues to gain traction in the UK, consumers are increasingly seeking secure and efficient payment methods that can be used both online and in physical stores. Contactless smart cards offer a versatile solution, allowing users to make purchases seamlessly across various platforms. Recent statistics indicate that e-commerce sales in the UK have grown by over 30% in the past year, highlighting the increasing reliance on digital transactions. This trend is likely to propel the demand for contactless smart cards, as businesses aim to provide integrated payment solutions that cater to the evolving preferences of consumers. The synergy between e-commerce growth and contactless technology is expected to drive market expansion, potentially increasing the market size by 25% by 2027.

Regulatory Support for Contactless Technology

Regulatory frameworks in the UK are increasingly supportive of contactless technology, which serves as a vital driver for the contactless smart-card market. The UK government and financial authorities have implemented policies that encourage the adoption of contactless payments, recognizing their potential to enhance economic efficiency and consumer convenience. For instance, the Financial Conduct Authority (FCA) has established guidelines that facilitate the integration of contactless payment systems across various sectors. This regulatory backing not only fosters consumer trust but also incentivizes businesses to invest in contactless solutions. As a result, the market is likely to see a steady increase in adoption rates, with estimates suggesting that by 2026, contactless transactions could represent over 60% of all card payments in the UK. Such supportive regulations are crucial for the sustained growth of the contactless smart-card market.

Technological Advancements in Card Production

Technological innovations in card production are playing a crucial role in the evolution of the contactless smart-card market. Enhanced manufacturing techniques, such as the use of advanced materials and improved chip technology, have led to the creation of more durable and efficient cards. These advancements not only increase the lifespan of the cards but also enhance their functionality, allowing for faster transaction speeds and improved security features. The integration of Near Field Communication (NFC) technology has become standard, enabling seamless interactions between cards and payment terminals. As manufacturers continue to invest in research and development, the contactless smart-card market is expected to benefit from these innovations, potentially increasing market penetration by up to 20% in the coming years. This technological progress is a significant driver, as it meets the evolving needs of consumers and businesses alike.