Supportive Regulatory Environment

The regulatory environment in France is increasingly supportive of the contactless smart-card market, facilitating its growth and adoption. Government policies aimed at promoting digital payments and enhancing financial inclusion are creating a favorable landscape for contactless technologies. As of 2025, regulations have been established to streamline the integration of contactless payment systems in various sectors, including public transportation and retail. The contactless smart-card market is benefiting from these initiatives, as they encourage businesses to adopt contactless solutions to comply with regulatory standards. Additionally, the French government has launched campaigns to educate consumers about the benefits of contactless payments, further driving market penetration. This supportive regulatory framework is likely to foster innovation and investment in the contactless smart-card market, ultimately enhancing the overall payment ecosystem in France.

Expansion of Contactless Infrastructure

The expansion of contactless infrastructure across France is a critical driver for the contactless smart-card market. As more merchants and service providers adopt contactless payment terminals, the accessibility and convenience of using contactless smart cards are significantly enhanced. Recent data indicates that the number of contactless payment terminals has increased by 40% in the past year, reflecting a growing commitment to modernizing payment systems. The contactless smart-card market is thus positioned to benefit from this infrastructure expansion, as consumers are more likely to utilize contactless cards when they encounter widespread acceptance. Furthermore, the integration of contactless technology in public transport systems is also contributing to market growth, as commuters increasingly prefer the ease of using contactless cards for fare payments. This ongoing expansion of contactless infrastructure is expected to drive further adoption and innovation within the contactless smart-card market.

Growing Demand for Contactless Payments

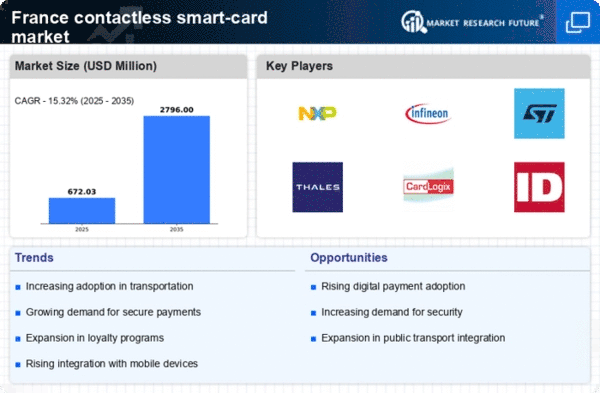

The contactless smart-card market in France is experiencing a notable surge in demand, primarily driven by the increasing preference for contactless payment methods among consumers. As of 2025, approximately 60% of transactions in retail settings are conducted using contactless technology, reflecting a significant shift in consumer behavior. This trend is further supported by the convenience and speed associated with contactless payments, which are perceived as safer and more efficient. The contactless smart-card market is thus poised for growth, as both consumers and merchants embrace this technology. Additionally, the rise of e-commerce and mobile payments has contributed to the expansion of contactless solutions, with many retailers integrating these systems into their payment infrastructure. This growing demand is likely to propel innovation and investment within the contactless smart-card market, fostering a competitive landscape that benefits both consumers and businesses.

Technological Advancements in Card Issuance

Technological advancements in card issuance are playing a pivotal role in shaping the contactless smart-card market in France. Innovations such as improved chip technology and enhanced encryption methods are making contactless cards more secure and efficient. As of 2025, the market has seen a 25% increase in the adoption of advanced chip technology, which not only enhances security but also improves transaction speed. The contactless smart-card market is benefiting from these advancements, as financial institutions and service providers are increasingly investing in state-of-the-art card production techniques. This trend is likely to continue, as the demand for secure and efficient payment solutions grows. Furthermore, the integration of biometric authentication features into contactless cards is expected to further bolster consumer confidence, thereby driving market growth. The ongoing evolution of technology in card issuance is thus a key driver for the contactless smart-card market.

Rising Consumer Awareness of Security Features

Consumer awareness regarding security features associated with contactless smart cards is on the rise in France, significantly impacting the contactless smart-card market. As individuals become more informed about the potential risks of card fraud and data breaches, they are increasingly seeking payment solutions that offer robust security measures. Recent surveys indicate that 70% of consumers prioritize security when choosing payment methods, which has led to a greater emphasis on the development of secure contactless smart cards. The contactless smart-card market is responding to this demand by implementing advanced security protocols, such as tokenization and encryption, to protect user data. This heightened focus on security not only reassures consumers but also encourages wider adoption of contactless payment solutions across various sectors, including retail and transportation. As security concerns continue to shape consumer preferences, the contactless smart-card market is likely to experience sustained growth.