Shift Towards 5G Deployment

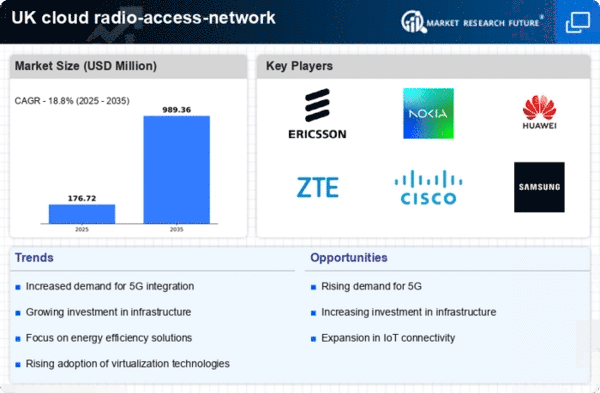

The transition to 5G technology is a pivotal driver for the cloud radio-access-network market in the UK. As telecom operators roll out 5G networks, the demand for cloud-based solutions that can efficiently manage and optimize these networks is expected to rise. The UK government has allocated £1.5 billion to support the rollout of 5G infrastructure, indicating a strong commitment to advancing telecommunications capabilities. This investment is likely to accelerate the adoption of cloud radio-access-network technologies, which can provide the necessary flexibility and scalability to handle the increased data traffic associated with 5G. Consequently, the cloud radio-access-network market is poised for significant growth as 5G becomes more prevalent.

Emergence of Edge Computing Solutions

The rise of edge computing is poised to have a transformative impact on the cloud radio-access-network market in the UK. As data processing increasingly shifts closer to the end-user, the need for efficient and responsive network architectures becomes critical. Cloud radio-access-networks can facilitate this shift by enabling distributed computing capabilities, thereby reducing latency and improving overall network performance. The UK is witnessing a growing trend towards deploying edge computing solutions, particularly in urban areas where demand for low-latency applications is high. This trend is likely to create new opportunities for the cloud radio-access-network market, as operators seek to integrate edge computing with their existing infrastructure to enhance service delivery.

Increased Focus on Network Resilience

In the context of the cloud radio-access-network market, the emphasis on network resilience is becoming increasingly pronounced. The UK has witnessed a growing recognition of the need for robust and reliable telecommunications infrastructure, particularly in light of recent challenges faced by the sector. As businesses and consumers demand uninterrupted connectivity, cloud radio-access-networks offer a solution that enhances network reliability through virtualization and redundancy. This focus on resilience is likely to drive investments in cloud radio-access-network technologies, as operators seek to ensure service continuity and mitigate potential disruptions. The market may see a shift towards solutions that prioritize resilience, thereby fostering growth in the cloud radio-access-network sector.

Growing Demand for High-Speed Connectivity

The UK is experiencing a surge in demand for high-speed connectivity in the cloud radio-access-network market. As consumers and businesses increasingly rely on data-intensive applications, the need for robust and efficient network solutions becomes paramount. The UK government has set ambitious targets for broadband coverage, aiming for 85% of homes to have access to gigabit-capable networks by 2025. This push for enhanced connectivity is likely to drive investments in cloud radio-access-network technologies, as they offer scalable and flexible solutions to meet the growing bandwidth requirements. Furthermore, the increasing adoption of IoT devices and smart technologies is expected to further fuel this demand, creating a conducive environment for the cloud radio-access-network market to thrive.

Regulatory Support for Telecommunications Innovation

The UK benefits from a regulatory environment that encourages innovation in the cloud radio-access-network market. The UK government, through Ofcom, has implemented policies aimed at fostering competition and enhancing service quality. These regulations are designed to facilitate the deployment of advanced network technologies, including cloud radio-access-networks. By promoting open access and reducing barriers to entry, the regulatory framework is likely to stimulate investment in next-generation network infrastructure. This supportive environment may lead to increased collaboration among telecom operators and technology providers, ultimately enhancing the capabilities and reach of the cloud radio-access-network market.