Shift Towards Network Slicing

The cloud radio-access-network market in China is witnessing a shift towards network slicing. This technology allows operators to create multiple virtual networks on a single physical infrastructure. This capability is particularly relevant in the context of 5G, where diverse applications require tailored network performance. By adopting cloud-based solutions, operators can efficiently manage resources and optimize network performance for various use cases, such as autonomous vehicles and remote healthcare. The potential for increased operational efficiency and reduced costs makes network slicing an attractive proposition for service providers. As the demand for customized services grows, the cloud radio-access-network market is expected to expand, driven by the need for flexible and efficient network management solutions.

Growing Focus on Cybersecurity

As the cloud radio-access-network market in China expands, the focus on cybersecurity becomes increasingly critical. With the rise of digital services and interconnected devices, the risk of cyber threats escalates. The Chinese government has recognized this challenge and is implementing stringent regulations to enhance cybersecurity measures across telecommunications networks. Investments in advanced security protocols and technologies are expected to rise, with estimates indicating a potential increase of 20% in cybersecurity spending by 2026. This heightened focus on security not only protects consumer data but also fosters trust in cloud-based solutions. Consequently, the cloud radio-access-network market is likely to benefit from these developments, as operators prioritize secure and resilient network architectures to safeguard their operations and customer information.

Increased Adoption of IoT Devices

The proliferation of IoT devices in China is a key driver for the cloud radio-access-network market. With estimates suggesting that there will be over 1 billion connected devices by 2025, the demand for robust and scalable network solutions is intensifying. Cloud radio-access-network technologies provide the necessary infrastructure to support the vast number of devices and the data they generate. This trend is further supported by the Chinese government's push for smart city initiatives, which rely heavily on IoT applications. The integration of cloud solutions allows for efficient data processing and management, which is essential for real-time analytics and decision-making. Consequently, the cloud radio-access-network market is likely to see substantial growth as businesses and municipalities seek to harness the potential of IoT.

Rising Demand for 5G Connectivity

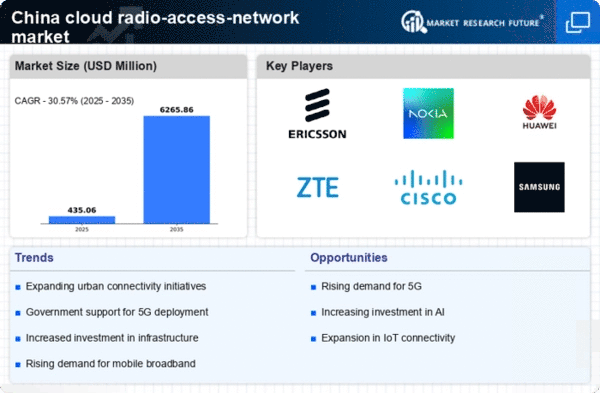

The cloud radio-access-network market in China is experiencing a surge in demand. This demand is driven by the rollout of 5G technology. As urban areas increasingly adopt 5G, the need for efficient and scalable network solutions becomes paramount. The Chinese government has invested heavily in 5G infrastructure, with expenditures reaching approximately $30 billion in 2025. This investment is expected to enhance mobile broadband services and support a myriad of applications, from IoT to smart cities. Consequently, the cloud radio-access-network market is poised to benefit from this trend, as operators seek to leverage cloud-based solutions to manage the increased data traffic and connectivity requirements associated with 5G. The integration of cloud technologies allows for more flexible and cost-effective network management, which is crucial in meeting the demands of a rapidly evolving digital landscape.

Government Initiatives and Policies

The cloud radio-access-network market in China is significantly influenced by government initiatives. These initiatives aim to promote digital transformation. Policies such as the 'Made in China 2025' strategy emphasize the importance of advanced telecommunications infrastructure. The government has set ambitious targets for expanding broadband access, with plans to cover 98% of urban areas by 2025. This regulatory support fosters an environment conducive to innovation and investment in cloud technologies. Furthermore, the establishment of favorable tax incentives for companies investing in cloud infrastructure is likely to stimulate growth in the market. As a result, the cloud radio-access-network market is expected to expand, driven by both public and private sector collaboration in enhancing network capabilities and accessibility.