Cost Efficiency and Resource Optimization

Cost efficiency remains a critical driver in the cloud electronic-design-automation market. By leveraging cloud-based solutions, companies can significantly reduce their capital expenditures on hardware and software. In the UK, firms are increasingly recognizing that cloud platforms can lower operational costs by up to 30%, allowing for better allocation of resources. This shift not only enhances financial performance but also enables smaller companies to access advanced design tools that were previously out of reach. The potential for resource optimization through cloud solutions is reshaping the competitive landscape, as businesses strive to maximize their return on investment. As a result, the cloud electronic-design-automation market is likely to see continued growth as organizations prioritize cost-effective solutions.

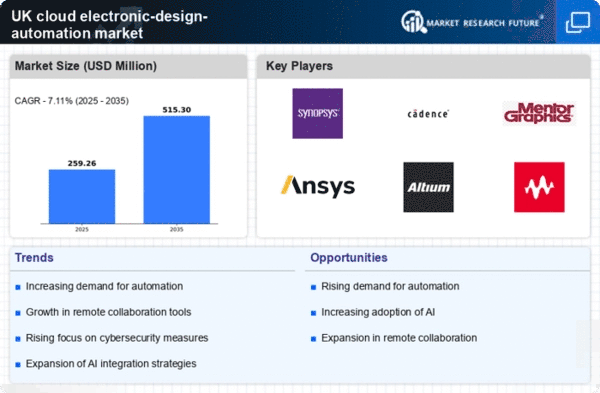

Rising Demand for Remote Design Solutions

The cloud electronic-design-automation market is experiencing a notable surge in demand for remote design solutions. This trend is largely driven by the increasing need for flexibility in design processes, allowing teams to collaborate seamlessly from various locations. In the UK, the market is projected to grow at a CAGR of approximately 15% over the next five years, reflecting the shift towards cloud-based platforms. Companies are increasingly adopting these solutions to enhance productivity and reduce time-to-market for electronic products. The ability to access design tools and resources from anywhere is becoming essential, particularly as businesses seek to optimize their operations in a competitive landscape. This driver indicates a significant transformation in how electronic design is approached, with cloud solutions at the forefront of this evolution.

Growing Adoption of Artificial Intelligence

The integration of artificial intelligence (AI) into the cloud electronic-design-automation market is emerging as a pivotal driver. AI technologies are being utilized to enhance design processes, automate repetitive tasks, and improve decision-making. In the UK, the adoption of AI in electronic design is projected to increase by over 20% in the coming years, as companies seek to leverage these capabilities for competitive advantage. This trend indicates a shift towards more intelligent design tools that can analyze vast amounts of data and provide insights that were previously unattainable. The potential for AI to streamline workflows and enhance creativity is likely to propel the cloud electronic-design-automation market forward, as organizations embrace innovation to stay ahead.

Increased Focus on Collaborative Development

Collaboration is becoming increasingly vital in the cloud electronic-design-automation market, as teams strive to work together more effectively. The rise of remote work has highlighted the need for tools that facilitate real-time collaboration among designers, engineers, and stakeholders. In the UK, the market is witnessing a shift towards platforms that support collaborative development, enabling multiple users to work on projects simultaneously. This driver suggests that the demand for integrated solutions that foster teamwork is likely to grow, as organizations recognize the benefits of collective input in the design process. Enhanced collaboration tools are expected to play a crucial role in shaping the future of the cloud electronic-design-automation market, driving innovation and improving project outcomes.

Enhanced Security and Compliance Requirements

As the cloud electronic-design-automation market expands, so do the concerns regarding data security and compliance. UK companies are increasingly prioritizing secure cloud environments to protect sensitive design data. The implementation of stringent regulations, such as GDPR, necessitates that businesses adopt cloud solutions that ensure compliance while safeguarding intellectual property. This driver suggests that the market is evolving to meet these heightened security demands, with providers offering advanced encryption and access controls. The emphasis on security is likely to influence purchasing decisions, as organizations seek reliable partners that can guarantee the protection of their data. Consequently, the cloud electronic-design-automation market is expected to adapt to these requirements, fostering trust and encouraging wider adoption.