Increased Investment in R&D

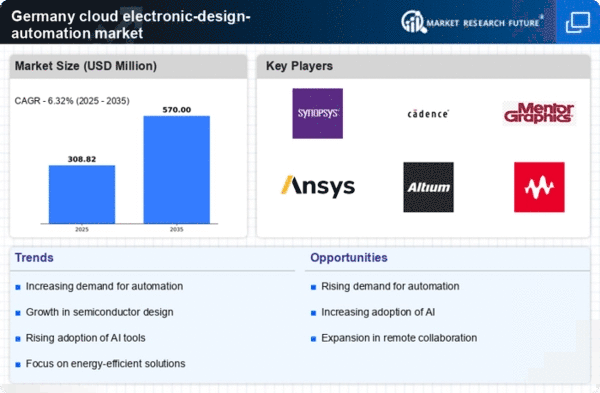

In Germany, there is a marked increase in investment in research and development (R&D) within the cloud electronic-design-automation market. Companies are allocating substantial budgets to develop innovative solutions that cater to evolving industry needs. Recent statistics reveal that R&D spending in the engineering sector has risen by 25% over the past two years. This investment not only fosters innovation but also enhances the capabilities of cloud-based design tools, making them more attractive to users. As a result, the The market is poised for growth, driven by the continuous development of advanced design technologies.

Growing Need for Scalability

The cloud electronic-design-automation market in Germany is witnessing a growing need for scalable solutions. As businesses expand, they require design tools that can adapt to increasing workloads without compromising performance. Cloud-based platforms offer the flexibility to scale resources according to project demands, which is particularly appealing to startups and SMEs. Data suggests that around 70% of small to medium-sized enterprises in Germany prefer cloud solutions for their scalability features. This trend indicates a shift towards more adaptable design environments, further propelling the growth of the cloud electronic-design-automation market.

Focus on Sustainability Initiatives

Sustainability has become a critical focus for many industries in Germany, influencing the cloud electronic-design-automation market. Companies are increasingly seeking eco-friendly design solutions that minimize environmental impact. The adoption of cloud-based tools allows for more efficient resource management and reduced energy consumption. Recent surveys indicate that 55% of engineering firms prioritize sustainability in their design processes. This emphasis on green practices not only aligns with regulatory requirements but also enhances brand reputation. Consequently, the cloud electronic-design-automation market is likely to benefit from this growing commitment to sustainable design practices.

Integration of Artificial Intelligence

The integration of artificial intelligence (AI) technologies into the cloud electronic-design-automation market is transforming design processes in Germany. AI-driven tools enhance design accuracy and efficiency, enabling engineers to automate repetitive tasks and focus on innovation. Reports indicate that AI adoption in engineering design is expected to grow by 40% over the next five years. This technological advancement allows for more complex designs and faster iterations, which are crucial in a competitive landscape. Consequently, the The market is likely to expand as companies seek to leverage AI capabilities to improve their design workflows.

Rising Demand for Remote Collaboration

The cloud electronic-design-automation market in Germany experiences a notable surge in demand for remote collaboration tools. As organizations increasingly adopt hybrid work models, the need for efficient design collaboration becomes paramount. This shift is reflected in the growing number of cloud-based platforms that facilitate real-time collaboration among design teams. According to recent data, approximately 65% of engineering firms in Germany have integrated cloud solutions to enhance teamwork and streamline workflows. This trend not only boosts productivity but also reduces time-to-market for new products, thereby driving growth in the cloud electronic-design-automation market.