Regulatory Framework Enhancements

The clinical data-analytics market is being shaped by ongoing enhancements in the regulatory framework governing healthcare data usage in the UK. Regulatory bodies are increasingly establishing guidelines that promote the ethical use of clinical data while ensuring patient privacy and security. These regulations are designed to foster trust among patients and healthcare providers, encouraging the adoption of data analytics solutions. As of November 2025, compliance with these regulations is becoming a prerequisite for organizations seeking to leverage clinical data for analytics. This regulatory support is likely to stimulate growth in the clinical data-analytics market, as organizations invest in compliant technologies and practices to harness the full potential of their data assets.

Increased Focus on Patient-Centric Care

The clinical data-analytics market is witnessing a shift towards patient-centric care, driven by the growing emphasis on personalized treatment plans. Healthcare providers in the UK are increasingly utilizing data analytics to tailor interventions based on individual patient needs, preferences, and outcomes. This approach not only enhances patient satisfaction but also improves clinical effectiveness. The market is expected to see a rise in the adoption of analytics tools that support personalized medicine, with projections indicating a potential increase in market size by 15% over the next few years. By leveraging data analytics, healthcare organizations can identify trends and patterns that inform personalized care strategies, thereby positioning themselves competitively within the clinical data-analytics market.

Advancements in Health Information Technology

Technological advancements in health information systems are significantly influencing the clinical data-analytics market. The integration of electronic health records (EHRs) and other digital health solutions facilitates the collection and analysis of clinical data, enabling healthcare providers to make informed decisions. The UK government has been actively promoting the adoption of digital health technologies, which is expected to enhance the quality of care and streamline operations. As of 2025, it is estimated that over 80% of healthcare facilities in the UK will have implemented EHR systems, providing a rich source of data for analytics. This technological evolution not only supports better patient management but also fosters innovation in the clinical data-analytics market, as organizations seek to harness the power of data for improved healthcare delivery.

Rising Demand for Data-Driven Decision Making

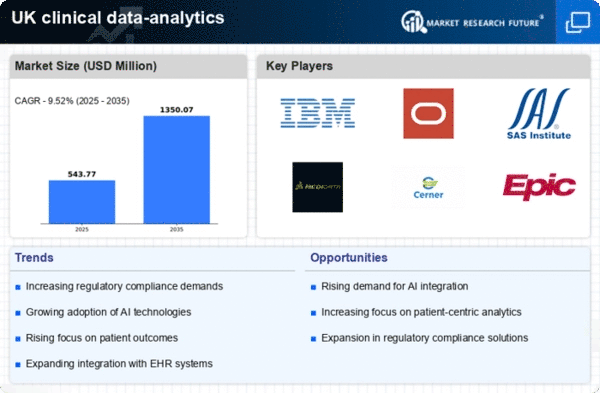

The clinical data-analytics market is experiencing a notable surge in demand for data-driven decision making among healthcare providers in the UK. This trend is largely attributed to the increasing recognition of the value of data in enhancing patient outcomes and operational efficiency. Healthcare organizations are increasingly leveraging analytics to derive insights from vast amounts of clinical data, which can lead to improved treatment protocols and resource allocation. According to recent estimates, the market is projected to grow at a CAGR of approximately 12% over the next five years, reflecting the growing reliance on data analytics in clinical settings. This shift towards data-centric approaches is likely to drive investments in advanced analytics tools and technologies, thereby propelling the clinical data-analytics market forward.

Growing Investment in Research and Development

Investment in research and development (R&D) within the healthcare sector is a critical driver of the clinical data-analytics market. The UK government and private entities are increasingly allocating funds towards innovative research initiatives that utilize data analytics to address pressing healthcare challenges. This focus on R&D is expected to yield new methodologies and technologies that enhance the capabilities of clinical data analytics. As of 2025, it is anticipated that R&D spending in the healthcare sector will reach approximately £5 billion, with a significant portion directed towards analytics-driven projects. This influx of investment is likely to accelerate advancements in the clinical data-analytics market, fostering a culture of innovation and continuous improvement in healthcare delivery.