Emergence of Big Data Technologies

The clinical data-analytics market is witnessing a transformative impact from the emergence of big data technologies. These technologies enable the processing and analysis of vast amounts of clinical data, facilitating insights that were previously unattainable. The ability to analyze unstructured data, such as clinical notes and imaging results, is particularly valuable in enhancing patient care. As healthcare organizations increasingly adopt big data solutions, the market is projected to expand significantly, with estimates suggesting a growth rate of over 20% annually. This shift towards big data analytics is likely to redefine how clinical data is utilized, leading to more informed decision-making and improved patient outcomes.

Rising Demand for Personalized Medicine

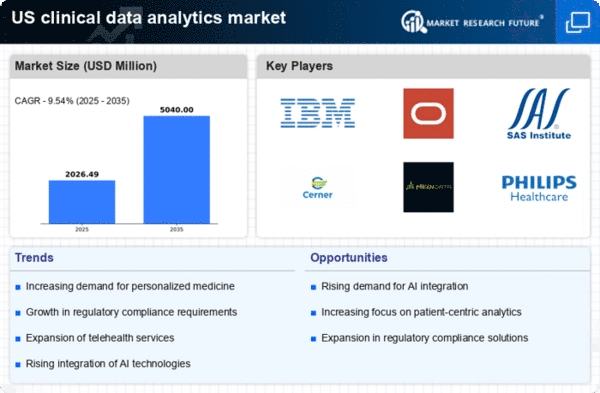

The clinical data-analytics market is experiencing a notable surge in demand for personalized medicine, driven by advancements in genomics and biotechnology. As healthcare providers increasingly seek tailored treatment plans, the need for sophisticated data analytics tools becomes paramount. This trend is reflected in the projected growth of the market, which is expected to reach approximately $10 billion by 2026. The ability to analyze vast datasets allows for the identification of patient-specific factors, leading to improved outcomes. Consequently, healthcare organizations are investing heavily in clinical data-analytics solutions to enhance their capabilities in delivering personalized care, thereby propelling the market forward.

Growing Adoption of Electronic Health Records

The clinical data-analytics market is benefiting from the widespread adoption of electronic health records (EHRs) across healthcare facilities in the US. EHRs serve as a rich source of clinical data, enabling healthcare providers to leverage analytics for improved decision-making and patient care. The integration of EHR systems with analytics platforms allows for real-time data analysis, enhancing clinical workflows and patient outcomes. As of 2025, approximately 85% of hospitals in the US have adopted EHR systems, creating a robust foundation for the growth of the clinical data-analytics market. This trend is expected to continue, as healthcare organizations recognize the value of data-driven insights in enhancing operational efficiency.

Increased Regulatory Focus on Data Management

The clinical data-analytics market is significantly influenced by the heightened regulatory focus on data management and reporting. Regulatory bodies in the US are implementing stringent guidelines to ensure the accuracy and integrity of clinical data. This has led to an increased demand for analytics solutions that can facilitate compliance with these regulations. For instance, the FDA's emphasis on data transparency and accountability has prompted healthcare organizations to adopt advanced analytics tools. As a result, the market is projected to grow at a CAGR of around 15% over the next few years, as organizations strive to meet regulatory requirements while optimizing their data management processes.

Enhanced Focus on Population Health Management

The clinical data-analytics market is increasingly driven by a focus on population health management. Healthcare providers are recognizing the importance of analyzing data at a population level to identify trends, manage chronic diseases, and improve overall health outcomes. This approach necessitates robust analytics capabilities to aggregate and interpret data from diverse sources. As a result, investments in clinical data-analytics solutions are on the rise, with the market expected to grow substantially in the coming years. The emphasis on preventive care and health management strategies is likely to propel the demand for analytics tools that can support these initiatives, ultimately enhancing the quality of care delivered to populations.