Rising Awareness of Bone Health

There is a growing awareness of bone health among the UK population, which is positively influencing the bone biopsy market. Public health campaigns and educational initiatives are increasingly focusing on the importance of early detection and treatment of bone diseases. This heightened awareness is leading to more individuals seeking medical advice and diagnostic procedures, including bone biopsies, to assess their bone health. As a result, healthcare providers are likely to see an uptick in referrals for bone biopsy procedures, contributing to market expansion. Furthermore, the integration of bone health education into routine healthcare practices may enhance patient engagement and compliance, further driving the demand for services within the bone biopsy market.

Investment in Research and Development

Investment in research and development (R&D) within the healthcare sector is playing a crucial role in advancing the bone biopsy market. Increased funding from both public and private sectors is facilitating the exploration of novel biopsy techniques and materials. In the UK, government initiatives aimed at promoting medical research are likely to enhance the capabilities of the bone biopsy market. This focus on R&D is expected to lead to the introduction of innovative products and services, improving the overall quality of care. As new technologies and methodologies emerge, the bone biopsy market may witness a transformation, characterized by enhanced diagnostic accuracy and patient safety.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is transforming the landscape of the bone biopsy market. Innovations such as robotic-assisted biopsy systems and minimally invasive techniques are enhancing the efficiency and safety of biopsy procedures. Innovations such as robotic-assisted biopsy systems and minimally invasive techniques are enhancing the efficiency and safety of biopsy procedures. In the UK, the adoption of these technologies is expected to increase, as they offer improved patient outcomes and reduced recovery times. The market is likely to benefit from the ongoing development of smart biopsy devices that incorporate artificial intelligence for better diagnostic capabilities. This technological evolution not only streamlines the biopsy process but also aligns with the broader trend of digital transformation in healthcare, thereby fostering growth in the bone biopsy market.

Increasing Demand for Diagnostic Accuracy

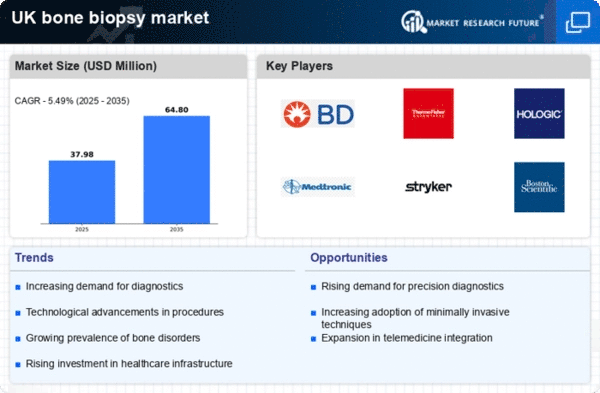

The bone biopsy market is experiencing a notable surge in demand for diagnostic accuracy, driven by advancements in imaging technologies and histopathological techniques. As healthcare providers strive to enhance patient outcomes, the need for precise and reliable diagnostic tools becomes paramount. In the UK, the market for bone biopsy procedures is projected to grow at a CAGR of approximately 6.5% over the next five years. This growth is indicative of a broader trend towards personalized medicine, where accurate diagnosis is essential for tailoring treatment plans. Consequently, the emphasis on diagnostic accuracy is likely to propel innovations in the bone biopsy market, fostering the development of more sophisticated biopsy devices and techniques.

Aging Population and Associated Health Issues

The demographic shift towards an aging population in the UK is significantly impacting the bone biopsy market. As individuals age, the prevalence of bone-related diseases, such as osteoporosis and metastatic bone cancer, tends to increase. This demographic trend suggests a growing need for effective diagnostic procedures, including bone biopsies, to identify and manage these conditions. According to recent statistics, the incidence of osteoporosis in the UK is expected to rise by 20% by 2030, further underscoring the importance of the bone biopsy market in addressing these health challenges. The increasing burden of age-related bone diseases is likely to drive demand for bone biopsy procedures, thereby stimulating market growth.