Rising Cybersecurity Threats

The escalating threat of cyberattacks is a critical concern for organizations in the UK, thereby impacting the Automated Infrastructure Management Aim Solutions Market. With the increasing sophistication of cyber threats, businesses are compelled to adopt automated solutions that enhance their security posture. The UK government has reported a significant rise in cyber incidents, prompting organizations to prioritize cybersecurity in their infrastructure management strategies. This heightened awareness is likely to drive demand for automated solutions that offer advanced security features, such as threat detection and response capabilities. Consequently, the market for automated infrastructure management solutions is expected to grow as organizations seek to safeguard their assets against potential cyber threats.

Growing Demand for Cloud-Based Solutions

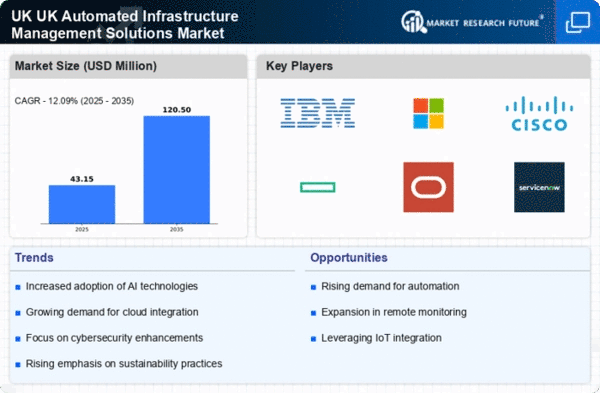

The UK Automated Infrastructure Management Aim Solutions Market is witnessing a notable shift towards cloud-based solutions. Organizations are increasingly adopting cloud technologies to enhance scalability and flexibility in their infrastructure management. According to recent data, the cloud services market in the UK is projected to reach approximately 40 billion GBP by 2026, indicating a robust growth trajectory. This trend is driven by the need for businesses to streamline operations and reduce costs associated with on-premises infrastructure. As companies migrate to the cloud, the demand for automated infrastructure management solutions that can seamlessly integrate with cloud environments is likely to rise, thereby propelling the market forward.

Increased Focus on Operational Efficiency

The pursuit of operational efficiency is a primary driver in the UK Automated Infrastructure Management Aim Solutions Market. Organizations are increasingly recognizing the importance of optimizing their infrastructure to reduce downtime and enhance productivity. Recent studies indicate that companies that implement automated infrastructure management solutions can achieve up to a 30% reduction in operational costs. This focus on efficiency is prompting businesses to invest in advanced technologies that facilitate real-time monitoring and management of their infrastructure. As the competitive landscape intensifies, the demand for solutions that can deliver measurable improvements in operational performance is likely to grow, further stimulating market expansion.

Regulatory Compliance and Data Protection

In the UK, stringent regulations surrounding data protection and compliance are significantly influencing the Automated Infrastructure Management Aim Solutions Market. The implementation of the General Data Protection Regulation (GDPR) has necessitated that organizations adopt robust infrastructure management solutions to ensure compliance. This regulatory landscape compels businesses to invest in automated solutions that can monitor, manage, and secure their data effectively. As a result, the market for automated infrastructure management solutions is expected to expand, with companies prioritizing compliance as a critical factor in their infrastructure strategies. The emphasis on data protection is likely to drive innovation and the development of new solutions tailored to meet these regulatory requirements.

Technological Advancements and Innovation

Technological advancements are playing a pivotal role in shaping the UK Automated Infrastructure Management Aim Solutions Market. Innovations in artificial intelligence, machine learning, and IoT are enabling organizations to automate complex infrastructure management tasks. These technologies facilitate predictive analytics, allowing businesses to anticipate issues before they arise, thereby minimizing disruptions. The UK government has been actively promoting digital transformation initiatives, which further encourages the adoption of innovative solutions. As organizations seek to leverage these advancements to enhance their infrastructure management capabilities, the market is likely to experience significant growth, driven by the demand for cutting-edge solutions that improve efficiency and reliability.