Google Cloud Will Launch New Telecom Engineer Tools in 2023. A new relationship with StarHub demonstrates how many advantages new products offer. A wide range of use cases, including big data analytics, artificial intelligence, simulation, virtual desktops, software development, and customer-facing web apps, are being used by engineering organisations of all shapes and sizes. One of the players in this game is Google Cloud.

To fulfil the rising need for high-performance computing solutions in the nation, Altos India, a division of Acer India, the worldwide PC giant, announced a series of cutting-edge workstations in 2023. The executives, IT specialists, partners, and industry leaders from Altos India were present at the inaugural event to show their dedication to providing customers with comprehensive solutions.

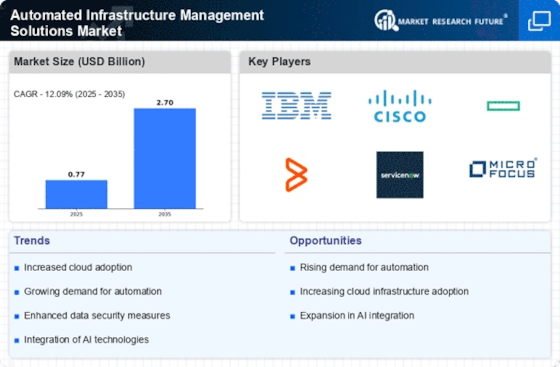

IBM introduced IBM Hybrid Cloud Mesh in 2023. This SaaS solution aims to help businesses manage their hybrid multicloud architecture. Modern businesses can operate their infrastructure across hybrid multicloud and heterogeneous environments thanks to IBM Hybrid Cloud Mesh, which is powered by "Application-Centric Connectivity" and designed to automate the process, management, and observability of application connectivity in and between public and private clouds.

The award-winning DevOps Automation Platform will be available in a new free trial edition in 2023, according to DuploCloud, the industry leader in DevOps automation with built-in compliance. Teams have access to all the essential components of DuploCloud's platform, including Kubernetes orchestration, automated resource scaling and optimisation, cost tracking, and monitoring.

Today, Puppet Inc. unveiled Puppet Comply, a software tool that businesses can use to make sure their on-premises and cloud infrastructure complies with cybersecurity standards in 2020. One of the most popular technologies on the market for automating infrastructure management is made by Puppet, which has its headquarters in Portland. Over the past few years, a number of the company's biggest competitors, including Ansible Inc., Chef Inc., and most recently SaltStack Inc., have been purchased by significant market players.

October 2021: IBM indicated on October 1, 2021, that it would separate off its infrastructure services business sector into a wholly new and autonomous company called Kyndryl by IBM. It will be organized by the management framework, with four identifiable segments: consulting, programs, infrastructure, and finance.

May 2021: Hewlett-Packard Enterprise will develop HPE drive into a cloud-native, software-defined information service company on May 4, 2021. Three new technologies are included in the HPE Green Lake: Data Services Cloud Console, Cloud information services, and HPE Alletra.

October 2020: Cisco introduced new software-delivered services designed to simplify IT management across on-premises data centers and multiple cloud platforms on October 28, 2020. By linking teams, infrastructure, and tools, this innovative software delivers features that expedite program and electronic delivery of services in a hyper-distributed environment.