Rising Demand for Mobile Connectivity

The 4g lte market in the UK is experiencing a notable surge in demand for mobile connectivity. As consumers increasingly rely on smartphones and mobile devices for daily activities, the need for robust and reliable internet access has intensified. Recent data indicates that mobile data traffic in the UK is projected to grow at a compound annual growth rate (CAGR) of approximately 30% over the next five years. This trend is driven by the proliferation of streaming services, social media, and online gaming, which require high-speed internet. Consequently, mobile network operators are compelled to enhance their 4g lte offerings to meet consumer expectations, thereby propelling growth in the 4g lte market.

Government Initiatives and Regulations

Government initiatives play a crucial role in shaping the 4g lte market in the UK. The UK government has implemented various policies aimed at improving digital infrastructure and promoting competition among service providers. For instance, the Digital Strategy aims to ensure that 95% of the UK has access to superfast broadband by 2025, which indirectly supports the expansion of 4g lte networks. Additionally, regulatory bodies such as Ofcom are actively working to allocate spectrum efficiently, facilitating the deployment of 4g lte services. These initiatives not only enhance connectivity but also stimulate investment in the 4g lte market, fostering innovation and competition among providers.

Increased Adoption of Mobile Applications

The increased adoption of mobile applications is a significant driver of growth in the 4g lte market. As more consumers turn to mobile apps for various services, including banking, shopping, and entertainment, the demand for high-speed internet access has escalated. Data suggests that the number of mobile app downloads in the UK has surpassed 2 billion annually, indicating a robust market for mobile services. This surge in app usage necessitates reliable and fast internet connections, prompting mobile network operators to enhance their 4g lte offerings. Consequently, the growth of mobile applications is likely to continue driving demand for 4g lte services in the UK.

Competitive Landscape Among Service Providers

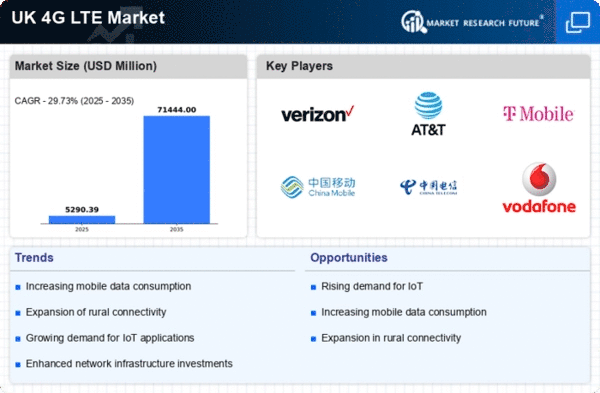

The competitive landscape among service providers is a pivotal factor influencing the 4g lte market in the UK. With multiple operators vying for market share, there is a constant push for improved service quality and pricing strategies. This competition has led to innovative pricing models, including unlimited data plans and bundled services, which attract consumers. Recent market analysis indicates that the top four mobile network operators control approximately 70% of the market share, intensifying the competition. As providers strive to differentiate themselves, investments in network enhancements and customer service are likely to increase, further stimulating growth in the 4g lte market.

Technological Advancements in Network Equipment

Technological advancements in network equipment are significantly influencing the 4g lte market in the UK. The introduction of more efficient base stations and antennas has improved network performance and coverage. Recent innovations, such as Massive MIMO (Multiple Input Multiple Output) technology, enable operators to increase capacity and enhance user experience. As a result, mobile network operators are investing heavily in upgrading their infrastructure to support these advancements. According to industry reports, investments in network equipment are expected to reach £1.5 billion by 2026, reflecting the commitment to enhancing 4g lte services. This trend is likely to drive competition and improve service quality in the 4g lte market.