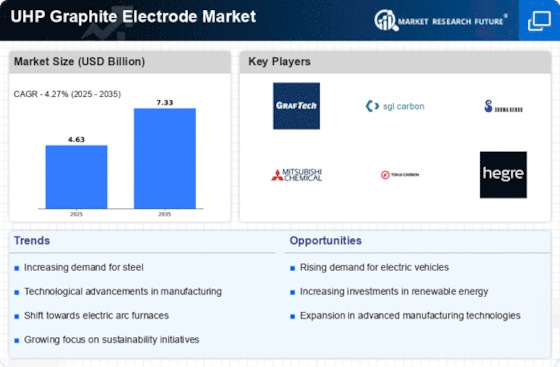

Increasing Steel Production

The UHP Graphite Electrode Market is experiencing a surge in demand due to the rising production of steel. As steel remains a fundamental material in construction and manufacturing, the need for electric arc furnaces (EAFs) has escalated. EAFs utilize UHP graphite electrodes for efficient steel production, which is projected to reach approximately 1.8 billion tons by 2025. This growth in steel production directly correlates with the increasing consumption of UHP graphite electrodes, as they are essential for the melting process. Furthermore, the shift towards more sustainable steel production methods, including the use of EAFs, is likely to bolster the UHP Graphite Electrode Market, as these electrodes are crucial for reducing carbon emissions in steel manufacturing.

Growth in Automotive Industry

The automotive industry is witnessing a transformation that is positively influencing the UHP Graphite Electrode Market. With the rise of electric vehicles and advancements in automotive technologies, the demand for UHP graphite electrodes is expected to grow. These electrodes are utilized in the production of components that require high thermal and electrical conductivity, making them essential for modern automotive applications. The automotive sector is projected to grow at a rate of approximately 5% annually, driven by the increasing adoption of electric vehicles and the need for lightweight materials. This growth is likely to create new opportunities for the UHP Graphite Electrode Market, as manufacturers seek to meet the evolving demands of the automotive market.

Expansion of Renewable Energy Sector

The expansion of the renewable energy sector is emerging as a pivotal driver for the UHP Graphite Electrode Market. As the world shifts towards cleaner energy sources, the demand for electric vehicles and energy storage systems is on the rise. UHP graphite electrodes are essential components in the production of lithium-ion batteries, which are widely used in electric vehicles and renewable energy storage solutions. The increasing focus on sustainability and the transition to electric mobility are expected to propel the demand for UHP graphite electrodes. Market analysts suggest that the renewable energy sector could account for a substantial share of the UHP Graphite Electrode Market, as the need for efficient energy storage solutions continues to grow.

Rising Demand from the Aerospace Industry

The aerospace industry is increasingly becoming a significant consumer of UHP graphite electrodes, thereby impacting the UHP Graphite Electrode Market. The demand for lightweight and high-strength materials in aerospace applications is driving manufacturers to utilize UHP graphite electrodes in various components. These electrodes are essential for producing advanced composite materials that are crucial for aircraft manufacturing. As the aerospace sector continues to expand, with projections indicating a growth rate of around 4.5% annually, the need for UHP graphite electrodes is likely to increase. This trend suggests that the UHP Graphite Electrode Market will benefit from the aerospace industry's ongoing innovations and the pursuit of more efficient and sustainable manufacturing processes.

Technological Innovations in Electrode Manufacturing

Technological advancements in the manufacturing processes of UHP graphite electrodes are significantly influencing the UHP Graphite Electrode Market. Innovations such as improved raw material sourcing, enhanced production techniques, and advanced quality control measures are leading to the development of more efficient and durable electrodes. These innovations not only enhance the performance of the electrodes but also reduce production costs, making them more accessible to a wider range of industries. As a result, the market is likely to witness an increase in the adoption of UHP graphite electrodes, particularly in sectors that require high-performance materials. The integration of automation and artificial intelligence in manufacturing processes further indicates a promising future for the UHP Graphite Electrode Market.