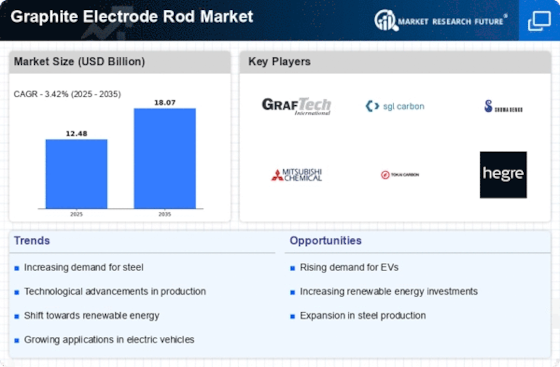

Increasing Steel Production

The demand for graphite electrode rods is closely tied to the steel production industry, which is experiencing a notable increase. As steel manufacturers seek to enhance their production capabilities, the need for high-quality graphite electrodes becomes paramount. In 2025, the steel production is projected to reach approximately 1.9 billion metric tons, indicating a robust growth trajectory. This surge in steel output is likely to drive the Graphite Electrode Rod Market, as these electrodes are essential for electric arc furnaces used in steelmaking. The correlation between steel production and graphite electrode demand suggests that as the former rises, so too will the latter, creating a favorable environment for market expansion.

Electrification of Industries

The ongoing electrification of various industries is anticipated to bolster the Graphite Electrode Rod Market significantly. As industries transition from traditional fossil fuel-based processes to electric-based systems, the reliance on electric arc furnaces is expected to increase. This shift is particularly evident in sectors such as aluminum and copper production, where graphite electrodes play a crucial role. The electrification trend is projected to contribute to a market growth rate of around 5% annually through 2025. Consequently, the demand for graphite electrode rods is likely to rise, driven by the need for efficient and sustainable production methods across multiple sectors.

Technological Innovations in Manufacturing

Technological advancements in the manufacturing processes of graphite electrode rods are poised to enhance product quality and reduce production costs. Innovations such as improved raw material sourcing and advanced production techniques are expected to streamline operations within the Graphite Electrode Rod Market. For instance, the introduction of automated systems and AI-driven quality control measures can lead to higher consistency and performance of the electrodes. As manufacturers adopt these technologies, the overall efficiency of production is likely to improve, potentially leading to a decrease in prices and an increase in market competitiveness. This evolution in manufacturing is expected to attract new players and expand the market further.

Growing Demand from Renewable Energy Sector

The renewable energy sector is emerging as a significant driver for the Graphite Electrode Rod Market. As the world shifts towards sustainable energy solutions, the demand for electric arc furnaces in the production of renewable energy components is increasing. Graphite electrodes are essential in the manufacturing of wind turbine components and solar panel frames, which are integral to the renewable energy infrastructure. The renewable energy market is projected to grow at a compound annual growth rate of over 8% through 2025, thereby creating a substantial demand for graphite electrode rods. This trend indicates a promising opportunity for market players to capitalize on the intersection of renewable energy and graphite electrode production.

Regulatory Support for Sustainable Practices

Regulatory frameworks promoting sustainable practices are likely to influence the Graphite Electrode Rod Market positively. Governments worldwide are implementing stricter environmental regulations, encouraging industries to adopt cleaner production methods. This regulatory support is expected to drive the demand for electric arc furnaces, which utilize graphite electrodes, as they are more energy-efficient and produce fewer emissions compared to traditional methods. The increasing emphasis on sustainability is projected to lead to a market growth rate of approximately 6% annually through 2025. As industries comply with these regulations, the demand for high-quality graphite electrode rods is expected to rise, further propelling market growth.