Growing E-commerce Sector

The rapid expansion of the e-commerce sector is significantly influencing the Global Track and Trace Solution Market Industry. As online shopping continues to gain traction, the need for efficient logistics and supply chain management becomes paramount. Track and trace solutions play a crucial role in ensuring timely deliveries and enhancing customer satisfaction by providing real-time tracking information. This trend is particularly evident in the logistics and transportation sectors, where companies are investing in advanced tracking technologies to streamline operations. The growth of e-commerce is expected to drive the market to new heights, with projections suggesting a market value of 16588.9 USD Billion by 2035.

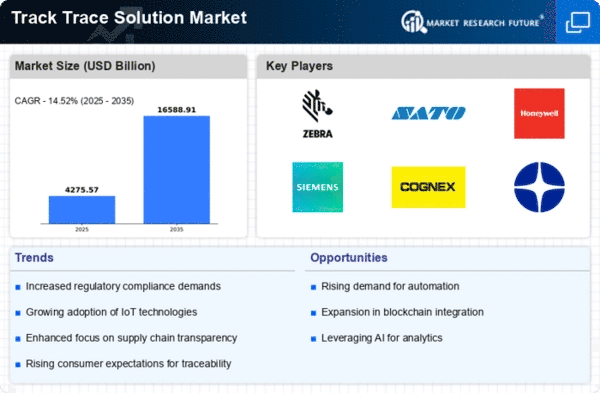

Market Growth Projections

The Global Track and Trace Solution Market Industry is poised for remarkable growth, with projections indicating a market value of 3733.5 USD Billion in 2024 and an anticipated rise to 16588.9 USD Billion by 2035. This growth trajectory suggests a robust compound annual growth rate (CAGR) of 14.52% from 2025 to 2035. Such figures underscore the increasing adoption of track and trace solutions across various sectors, driven by regulatory compliance, technological advancements, and consumer demand for transparency. The market's expansion reflects a broader trend towards enhanced supply chain management and product safety, positioning it as a critical area for investment and innovation.

Increasing Regulatory Compliance

The Global Track and Trace Solution Market Industry is experiencing growth driven by stringent regulatory requirements across various sectors, particularly in pharmaceuticals and food safety. Governments worldwide are implementing regulations that mandate the tracking of products throughout their supply chains to ensure safety and authenticity. For instance, the Drug Supply Chain Security Act in the United States requires enhanced traceability of prescription drugs. This regulatory landscape compels companies to adopt track and trace solutions, thereby contributing to the market's expansion. As a result, the market is projected to reach 3733.5 USD Billion in 2024, reflecting the urgency for compliance-driven technologies.

Rising Demand for Supply Chain Transparency

In the Global Track and Trace Solution Market Industry, the demand for enhanced supply chain transparency is a pivotal driver. Consumers and businesses alike are increasingly concerned about product origins and authenticity, particularly in industries such as food and pharmaceuticals. This trend is prompting organizations to implement track and trace solutions to provide real-time visibility into their supply chains. By leveraging technologies such as blockchain and IoT, companies can ensure product integrity and build consumer trust. As transparency becomes a competitive advantage, the market is expected to grow significantly, with projections indicating a CAGR of 14.52% from 2025 to 2035.

Consumer Awareness and Demand for Product Safety

Consumer awareness regarding product safety and authenticity is a significant driver in the Global Track and Trace Solution Market Industry. As consumers become more informed about the risks associated with counterfeit products, there is a growing demand for solutions that ensure product integrity. Industries such as pharmaceuticals and food are particularly affected, as counterfeit goods can pose serious health risks. Companies are responding by implementing track and trace solutions that provide transparency and assurance to consumers. This heightened awareness is likely to propel market growth, as businesses seek to align with consumer expectations and regulatory standards.

Technological Advancements in Tracking Solutions

Technological innovations are reshaping the Global Track and Trace Solution Market Industry, as advancements in RFID, barcoding, and IoT are enhancing tracking capabilities. These technologies enable real-time data collection and analysis, allowing businesses to monitor products throughout their lifecycle. For example, RFID tags can provide precise location data, improving inventory management and reducing losses. As companies increasingly adopt these advanced tracking solutions, the market is poised for substantial growth. The integration of artificial intelligence and machine learning further augments these solutions, enabling predictive analytics and improved decision-making processes, which are critical for maintaining competitive advantage.