Rising Environmental Concerns

Environmental sustainability is becoming a critical driver in the track geometry-measurement-system market. As rail operators aim to reduce their carbon footprint, there is a growing emphasis on technologies that promote eco-friendly practices. The adoption of energy-efficient measurement systems can contribute to lower energy consumption and reduced emissions. Furthermore, regulatory bodies are increasingly advocating for sustainable practices within the rail industry, which may lead to stricter compliance requirements. This shift towards sustainability is likely to create opportunities for companies that develop innovative measurement solutions that align with environmental goals. The track geometry-measurement-system market could see a rise in demand for systems that not only ensure safety and efficiency but also support the industry's commitment to environmental stewardship.

Expansion of High-Speed Rail Projects

The expansion of high-speed rail projects in the US is significantly influencing the track geometry-measurement-system market. As states invest in high-speed rail infrastructure to enhance connectivity and reduce travel times, the need for precise track geometry measurements becomes paramount. High-speed rail systems require stringent maintenance protocols to ensure safety and performance, which drives the demand for advanced measurement technologies. The market is expected to benefit from the projected growth of high-speed rail networks, with investments estimated to reach $20 billion over the next decade. This expansion not only necessitates the use of sophisticated measurement systems but also presents opportunities for innovation and development within the track geometry-measurement-system market.

Technological Integration and Automation

The integration of advanced technologies such as artificial intelligence (AI) and machine learning into the track geometry-measurement-system market is transforming the landscape. These technologies enable real-time data analysis and predictive maintenance, allowing rail operators to address potential issues before they escalate. The market is witnessing a shift towards automated measurement systems that can operate with minimal human intervention, thereby increasing efficiency and reducing operational costs. As rail companies seek to optimize their maintenance schedules and enhance the reliability of their services, the adoption of automated track geometry-measurement systems is expected to rise. This trend indicates a significant opportunity for market players to innovate and offer solutions that align with the evolving needs of the rail industry.

Growing Demand for Safety and Maintenance

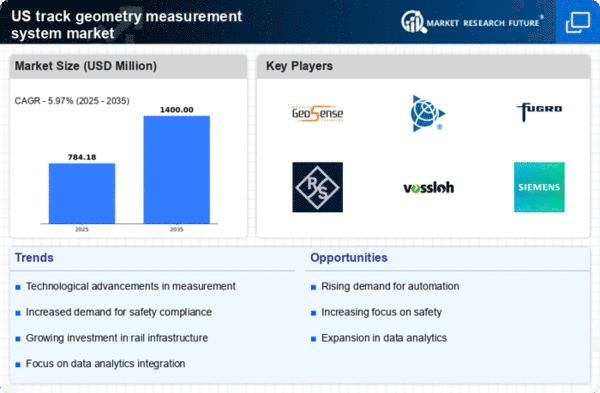

Safety concerns in rail operations are propelling the track geometry-measurement-system market forward. With the increasing frequency of rail accidents, there is a heightened focus on preventive maintenance and safety protocols. The Federal Railroad Administration has mandated regular inspections of track conditions, which necessitates the use of advanced measurement systems. The market is projected to grow at a CAGR of around 5.5% as rail operators invest in technologies that enhance safety and reduce the risk of derailments. This growing demand for safety and maintenance solutions is likely to drive innovation in the track geometry-measurement-system market, as companies strive to develop more accurate and efficient measurement technologies to meet regulatory requirements and improve overall rail safety.

Increasing Investment in Rail Infrastructure

The track geometry-measurement-system market is experiencing a surge in demand due to increasing investments in rail infrastructure across the US. Government initiatives aimed at modernizing rail networks are driving this trend. For instance, the US Department of Transportation has allocated substantial funding for rail projects, which is expected to reach approximately $66 billion over the next five years. This investment is likely to enhance the safety and efficiency of rail operations, thereby increasing the need for advanced track geometry-measurement systems. As rail operators seek to comply with safety standards and improve operational efficiency, the market for these measurement systems is poised for growth. The emphasis on maintaining optimal track conditions further underscores the importance of accurate measurement systems in ensuring the longevity and reliability of rail infrastructure.