Regulatory Pressures

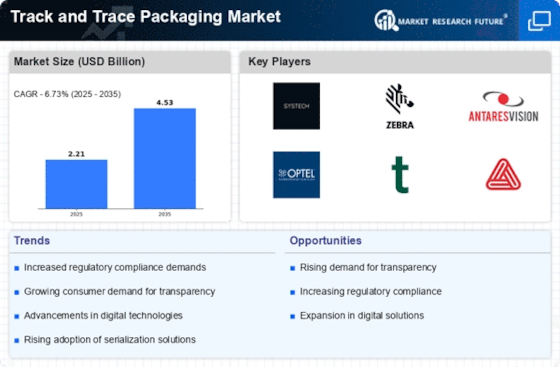

Regulatory pressures are a driving force in the Track and Trace Packaging Market, as governments worldwide implement stringent guidelines to combat counterfeit goods and ensure product safety. The introduction of regulations such as the Drug Supply Chain Security Act in the United States mandates that pharmaceutical companies adopt traceability measures. This has led to a marked increase in demand for track and trace solutions, with the market expected to grow at a compound annual growth rate of over 15% through 2025. Compliance with these regulations not only protects consumers but also enhances brand reputation, making it a critical factor for companies operating in sectors such as pharmaceuticals, food and beverage, and cosmetics.

Supply Chain Optimization

Supply chain optimization is a crucial driver in the Track and Trace Packaging Market, as businesses seek to enhance efficiency and reduce costs. The ability to track products in real-time allows companies to identify bottlenecks and streamline operations, ultimately leading to improved profitability. As of 2025, the market for supply chain management solutions is projected to exceed 30 billion USD, underscoring the importance of effective tracking systems. By implementing track and trace technologies, organizations can achieve greater visibility across their supply chains, enabling them to respond swiftly to market demands and minimize waste. This optimization not only benefits the bottom line but also enhances customer satisfaction through timely deliveries and accurate order fulfillment.

Sustainability Initiatives

Sustainability initiatives are becoming a pivotal driver in the Track and Trace Packaging Market, as companies strive to reduce their environmental footprint. The increasing emphasis on eco-friendly packaging solutions is prompting manufacturers to adopt materials that are recyclable and biodegradable. In 2025, the market for sustainable packaging is anticipated to reach 400 billion USD, reflecting a growing commitment to environmental responsibility. This trend is not merely a response to consumer preferences; it is also influenced by regulatory frameworks that encourage sustainable practices. By integrating track and trace technologies with sustainable packaging, companies can enhance their brand image while contributing to a more sustainable future.

Technological Advancements

The Track and Trace Packaging Market is experiencing a surge in technological advancements, particularly in the realms of RFID and blockchain technologies. These innovations enhance the ability to monitor products throughout the supply chain, ensuring authenticity and reducing counterfeiting. As of 2025, the market for RFID technology alone is projected to reach approximately 10 billion USD, indicating a robust demand for integrated solutions. The incorporation of IoT devices further facilitates real-time tracking, which is becoming increasingly essential for manufacturers and retailers alike. This technological evolution not only streamlines operations but also fosters consumer trust, as buyers are more inclined to purchase products that offer transparency regarding their origin and journey.

Consumer Demand for Transparency

Consumer demand for transparency is reshaping the Track and Trace Packaging Market, as buyers increasingly seek information about the products they purchase. This trend is particularly pronounced in sectors like food and pharmaceuticals, where consumers are concerned about safety and authenticity. A recent survey indicates that over 70% of consumers are willing to pay a premium for products that provide clear traceability information. This shift in consumer behavior is prompting companies to invest in advanced packaging solutions that offer detailed tracking capabilities. As a result, the market is witnessing a significant transformation, with businesses recognizing that transparency not only meets consumer expectations but also serves as a competitive advantage.