Increased Security Concerns

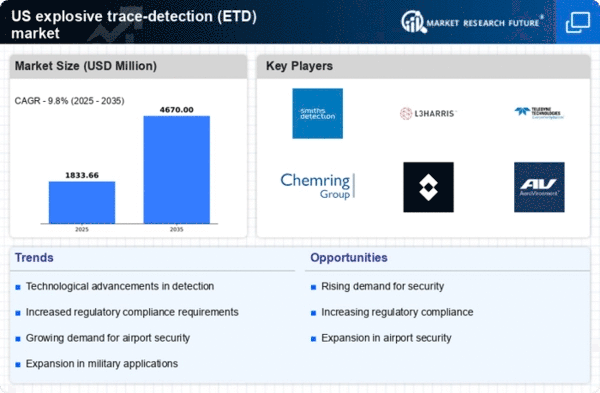

The explosive trace-detection-etd market is experiencing growth driven by heightened security concerns across various sectors. With the rise in global terrorism and domestic threats, there is a pressing need for advanced detection systems. Government agencies and private organizations are investing heavily in security measures, leading to an estimated market value of $1.5 billion by 2026. This investment is not only in technology but also in training personnel to effectively utilize these systems. The explosive trace-detection-etd market is thus positioned to benefit from increased funding and focus on security protocols, ensuring that detection capabilities are robust and reliable.

Rising Demand in Law Enforcement

The explosive trace-detection-etd market is also being driven by the rising demand for advanced detection technologies within law enforcement agencies. As crime rates fluctuate and the nature of threats evolves, police and security forces are increasingly adopting sophisticated detection systems to enhance public safety. This trend is reflected in budget allocations, with law enforcement agencies expected to invest over $500 million in detection technologies by 2025. The explosive trace-detection-etd market is thus likely to see a robust increase in product offerings tailored to meet the specific needs of these agencies.

Regulatory Compliance and Standards

Regulatory frameworks play a crucial role in shaping the explosive trace-detection-etd market. Agencies such as the Transportation Security Administration (TSA) and the Federal Aviation Administration (FAA) impose stringent regulations that necessitate the use of advanced detection technologies. Compliance with these regulations is mandatory for airports, transportation hubs, and public venues, driving demand for effective trace-detection systems. The explosive trace-detection-etd market is likely to see a surge in product development and innovation as companies strive to meet these evolving standards, potentially leading to a market growth rate of 8% annually.

Expansion of Transportation Networks

The expansion of transportation networks in the US is significantly impacting the explosive trace-detection-etd market. As new airports, railways, and shipping ports are developed, the need for enhanced security measures becomes paramount. This expansion is accompanied by increased passenger and cargo volumes, which necessitate the implementation of advanced detection systems to ensure safety. The explosive trace-detection-etd market is projected to grow as transportation authorities allocate budgets for state-of-the-art detection technologies, with estimates suggesting a market size increase to $2 billion by 2027.

Technological Innovations in Detection Methods

Technological innovations are reshaping the explosive trace-detection-etd market, with new methods and materials enhancing detection capabilities. Developments in nanotechnology and sensor technology are leading to more sensitive and accurate detection systems. These innovations not only improve the reliability of trace detection but also reduce false positives, which is critical for operational efficiency. The explosive trace-detection-etd market is expected to benefit from these advancements, with a projected growth rate of 10% as companies invest in research and development to stay competitive.