Regulatory Mandates

Regulatory mandates regarding vehicle safety are a crucial driver for the Tire Pressure Monitoring System Market. Many regions have implemented laws requiring the installation of tire pressure monitoring systems in new vehicles. These regulations aim to reduce the incidence of tire-related accidents and improve overall road safety. For instance, certain jurisdictions have established standards that necessitate the inclusion of TPMS in all passenger vehicles. As compliance with these regulations becomes mandatory, automotive manufacturers are compelled to integrate tire pressure monitoring systems into their vehicles. This regulatory landscape is expected to propel the growth of the Tire Pressure Monitoring System Market, as adherence to safety standards drives demand for these essential systems.

Focus on Fuel Efficiency

The increasing focus on fuel efficiency is another significant driver for the Tire Pressure Monitoring System Market. Proper tire inflation is directly linked to fuel consumption; under-inflated tires can lead to higher fuel usage and increased emissions. As consumers and manufacturers alike prioritize sustainability and cost-effectiveness, the demand for tire pressure monitoring systems is likely to rise. These systems help ensure that tires are maintained at optimal pressure, thereby enhancing fuel efficiency and reducing environmental impact. The automotive industry is increasingly recognizing the importance of fuel-efficient technologies, and tire pressure monitoring systems are integral to this effort. As a result, the Tire Pressure Monitoring System Market is expected to experience growth as more vehicles adopt these systems to meet fuel efficiency goals.

Rising Vehicle Production

The increasing production of vehicles is a primary driver for the Tire Pressure Monitoring System Market. As automotive manufacturers ramp up production to meet consumer demand, the integration of advanced safety features, including tire pressure monitoring systems, becomes essential. In recent years, the automotive sector has witnessed a notable surge, with millions of vehicles produced annually. This trend is expected to continue, as manufacturers strive to enhance vehicle safety and performance. Consequently, the demand for tire pressure monitoring systems is likely to rise, as they play a crucial role in preventing tire-related accidents and improving fuel efficiency. The Tire Pressure Monitoring System Market is thus positioned to benefit from this upward trajectory in vehicle production, as more vehicles equipped with these systems hit the roads.

Technological Advancements

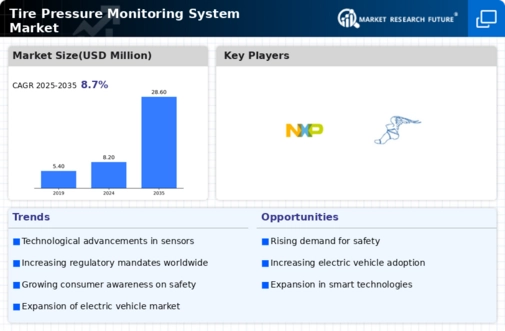

Technological advancements in tire pressure monitoring systems are significantly influencing the Tire Pressure Monitoring System Market. Innovations such as direct and indirect TPMS, which provide real-time tire pressure data, are becoming increasingly prevalent. These systems utilize sensors to monitor tire pressure and relay information to the driver, enhancing safety and convenience. Furthermore, the integration of smart technologies, such as connectivity with mobile applications, allows for remote monitoring and alerts. As consumers become more tech-savvy, the demand for these advanced systems is expected to grow. The market is projected to expand as manufacturers invest in research and development to create more sophisticated tire pressure monitoring solutions, thereby driving the overall growth of the Tire Pressure Monitoring System Market.

Increasing Awareness of Road Safety

The growing awareness of road safety among consumers is a significant driver for the Tire Pressure Monitoring System Market. As more individuals recognize the importance of maintaining proper tire pressure for vehicle safety, the demand for tire pressure monitoring systems is likely to increase. Educational campaigns and government initiatives aimed at promoting road safety have contributed to this heightened awareness. Studies indicate that under-inflated tires can lead to reduced fuel efficiency and increased risk of accidents. Consequently, consumers are more inclined to invest in vehicles equipped with tire pressure monitoring systems, which provide real-time feedback on tire conditions. This trend is expected to bolster the Tire Pressure Monitoring System Market, as manufacturers respond to consumer preferences for enhanced safety features.