Rising Energy Costs

The escalating costs of traditional energy sources are propelling the Thin Film Photovoltaic and Battery Market forward. As fossil fuel prices fluctuate and energy demand continues to rise, consumers are increasingly turning to renewable energy solutions as a cost-effective alternative. In 2025, the levelized cost of electricity (LCOE) for thin film solar technologies is expected to decrease further, making them more competitive against conventional energy sources. This economic advantage encourages both residential and commercial sectors to invest in thin film photovoltaic systems. The Thin Film Photovoltaic and Battery Market is thus likely to thrive as more consumers recognize the long-term savings associated with renewable energy investments.

Growing Environmental Awareness

The growing environmental awareness among consumers and businesses is a significant driver for the Thin Film Photovoltaic and Battery Market. As public consciousness regarding climate change and environmental degradation increases, there is a marked shift towards sustainable energy solutions. In 2025, surveys indicate that over 70% of consumers prioritize eco-friendly products, influencing their purchasing decisions. This trend is particularly evident in the adoption of thin film photovoltaics, which offer a lower environmental impact compared to traditional solar technologies. The Thin Film Photovoltaic and Battery Market stands to gain from this heightened awareness, as more individuals and organizations seek to align their energy choices with their environmental values.

Government Incentives and Policies

Government incentives and supportive policies play a crucial role in propelling the Thin Film Photovoltaic and Battery Market. Many countries have implemented favorable regulations, tax credits, and subsidies to encourage the adoption of renewable energy technologies. For instance, in 2025, several regions are expected to enhance their financial support for solar energy projects, which could lead to a significant uptick in thin film photovoltaic installations. These initiatives not only lower the initial investment barriers for consumers but also stimulate innovation within the industry. As a result, the Thin Film Photovoltaic and Battery Market is likely to experience accelerated growth, driven by a conducive regulatory environment that promotes sustainable energy solutions.

Increasing Demand for Renewable Energy

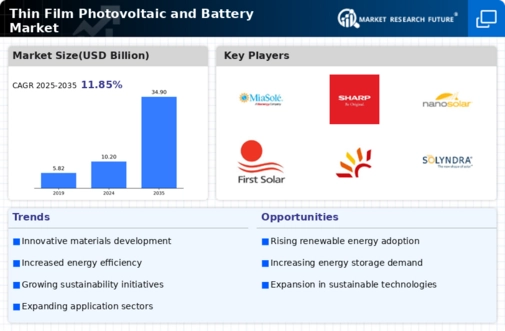

The rising demand for renewable energy sources is a pivotal driver for the Thin Film Photovoltaic and Battery Market. As nations strive to meet energy needs sustainably, the adoption of solar technologies, particularly thin film photovoltaics, is accelerating. In 2025, the market for thin film solar cells is projected to reach approximately 20 billion USD, reflecting a compound annual growth rate of around 15%. This surge is largely attributed to the growing awareness of climate change and the need for cleaner energy solutions. Furthermore, the integration of thin film technologies into various applications, including residential and commercial sectors, enhances their appeal. The Thin Film Photovoltaic and Battery Market is thus positioned to benefit from this increasing demand, as consumers and businesses alike seek to reduce their carbon footprints.

Technological Innovations in Energy Storage

Technological innovations in energy storage systems are significantly influencing the Thin Film Photovoltaic and Battery Market. Advances in battery technologies, such as lithium-ion and solid-state batteries, are enhancing the efficiency and longevity of energy storage solutions. In 2025, the energy storage market is anticipated to reach over 30 billion USD, with a substantial portion attributed to the integration of thin film photovoltaics. These innovations enable better energy management, allowing consumers to store excess solar energy for later use. Consequently, the synergy between thin film photovoltaics and advanced battery technologies is likely to drive market growth, as consumers seek reliable and efficient energy solutions.

Leave a Comment