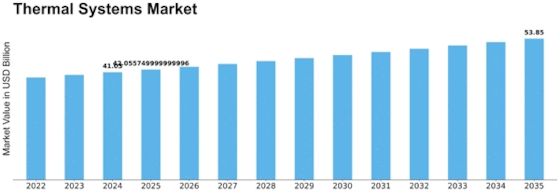

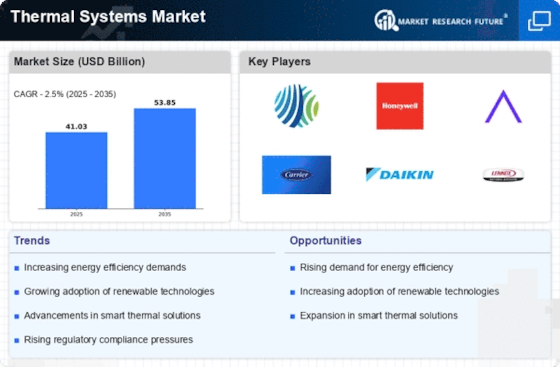

Thermal Systems Size

Thermal Systems Market Growth Projections and Opportunities

The Thermal Systems Market is influenced by a myriad of factors that collectively shape its dynamics. One pivotal factor is technological advancements. As technology continues to evolve, the thermal systems market witnesses the integration of cutting-edge innovations. This includes the development of more efficient and sustainable heating, ventilation, and air conditioning (HVAC) systems. The demand for eco-friendly solutions, driven by environmental concerns and stringent regulations, has pushed the market towards the adoption of energy-efficient thermal systems.

Global economic conditions play a crucial role in determining the trajectory of the thermal systems market. Economic stability, growth rates, and overall consumer confidence impact the construction and industrial sectors, both major consumers of thermal systems. In times of economic prosperity, there tends to be an uptick in construction activities, boosting the demand for heating and cooling systems. Conversely, economic downturns may lead to a slowdown in construction projects, affecting the thermal systems market adversely.

Government policies and regulations also exert a significant influence on the thermal systems market. Increasing emphasis on energy efficiency and environmental sustainability has prompted governments worldwide to implement stringent regulations. This has, in turn, spurred innovation within the industry, as manufacturers strive to meet and exceed these standards. Incentives and subsidies for adopting energy-efficient thermal systems further shape the market landscape, encouraging businesses and consumers alike to invest in environmentally friendly solutions.

Consumer preferences and awareness are key drivers of the thermal systems market. As awareness of climate change and environmental issues grows, consumers are increasingly inclined towards sustainable products. This shift in consumer preferences has prompted manufacturers to prioritize the development of energy-efficient and eco-friendly thermal systems. Additionally, the rise of smart technology has led to the integration of smart and connected features in thermal systems, catering to the demand for greater control and automation.

Market competition and industry consolidation also play a crucial role in shaping the thermal systems landscape. The market is characterized by the presence of numerous players, ranging from established multinational corporations to emerging startups. Intense competition fosters innovation and drives companies to differentiate their products through features, pricing, and overall performance. Mergers and acquisitions within the industry contribute to consolidation, influencing market dynamics and the competitive landscape.

Geopolitical factors can impact the thermal systems market by affecting the global supply chain. Trade tensions, political instability, and shifts in diplomatic relations can disrupt the sourcing of raw materials and components, leading to supply chain challenges. Manufacturers may need to adapt their strategies to navigate geopolitical uncertainties, potentially affecting pricing and availability of thermal systems.

Finally, societal trends and demographic shifts contribute to the evolving nature of the thermal systems market. Urbanization, changing lifestyles, and an aging population influence the demand for different types of thermal systems. Urban dwellers may prioritize compact and efficient HVAC solutions, while an aging population may drive demand for heating systems that cater to specific comfort needs.

Leave a Comment