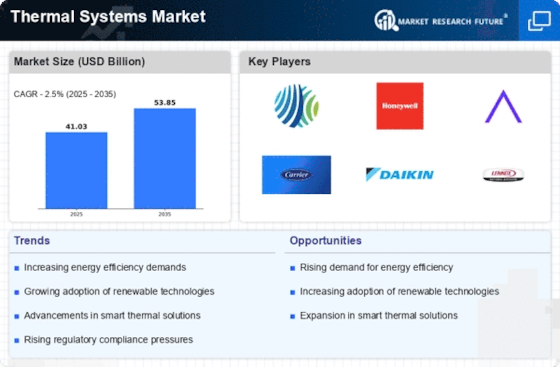

Top Industry Leaders in the Thermal Systems Market

The Competitive Landscape of the Thermal Systems Market

Across the sprawling landscapes of factories, the cozy confines of homes, and the intricate network of data centers, a silent symphony of temperature control unfolds. Conducted by the deft hands of thermal systems, this dynamic market pulsates with the competitive energy of players vying for control of these invisible conductors of comfort and efficiency. Unveiling the strategies, crucial factors, and overall landscape of this intricate market is vital for navigating its currents and securing a winning performance.

Key Players:

- 3M

- Intel Corporation

- Parker Hannifin Corporation

- Honeywell International Inc.

- Siemens AG

- Johnson Controls International Plc

- Emerson Electric Co.

- Schneider Electric SE

- Daikin Industries, Ltd

- Mitsubishi Electric Corporation

Strategies Adopted by Leaders:

- Technological Prowess: Johnson Controls and United Technologies lead the charge with advanced chillers, boilers, heat pumps, and control systems offering superior energy efficiency, precise temperature control, and intelligent optimization capabilities, catering to demanding needs across diverse sectors.

- Vertical Specialization: Carrier and Trane focus on specific segments like commercial buildings or industrial process cooling, achieving unmatched expertise and cost-effectiveness within their chosen domains.

- Integrated Solutions and Platform Play: Honeywell offers comprehensive packages with HVAC equipment, sensors, and building management systems, simplifying design and optimizing system performance for diverse applications.

- Focus on Miniaturization and Compact Design: Developing smaller, lighter systems with increased heat transfer capabilities opens doors to retrofitting buildings, integrating into tight spaces, and minimizing installation costs.

- Embrace of Sustainability and Green Technologies: Implementing energy-efficient systems, utilizing renewable energy sources, and offering carbon-neutral solutions contributes to a greener industry and attracts clients with ambitious environmental goals.

Critical Factors for Market Share Analysis:

- Energy Efficiency and Performance: Companies offering systems with superior thermal transfer, minimal energy consumption, and low carbon footprint command premium prices and secure market share by minimizing operating costs and attracting clients focused on sustainability.

- Versatility and Application Range: Providing systems capable of handling diverse temperature requirements, spanning from industrial process cooling to residential heating and cooling, expands market reach and attracts clients with varied needs.

- Reliability and Long-Term Operation: Delivering systems with extended lifespans, minimal maintenance requirements, and robust designs for harsh environments builds trust and minimizes downtime for clients relying on consistent temperature control.

- Ease of Integration and System Compatibility: Offering readily available mounting hardware, intuitive control interfaces, and compatibility with diverse smart building systems simplifies installation and streamlines integration.

- Cost Competitiveness and Budget Optimization: Balancing advanced functionalities with an attractive price point is crucial for capturing market share, particularly in price-sensitive sectors like residential construction and hospitality.

New and Emerging Companies:

- Startups like Nest Labs and Ecobee: These innovators focus on developing smart thermostats and connected HVAC systems with intelligent controls, AI-powered energy optimization, and remote monitoring capabilities, pushing the boundaries of user experience and efficiency.

- Academia and Research Labs: MIT's Energy Initiative and Stanford University's Environmental Engineering Department explore disruptive technologies like solar thermal systems, integrated heat recovery systems, and advanced materials for efficient heat transfer, shaping the future of the market.

- Material Science Companies: Saint-Gobain and Dow Chemical develop advanced insulation materials, heat exchanger materials, and intelligent coatings with exceptional thermal properties, enabling the development of next-generation high-performance systems.

Industry Developments:

3M:

- Jan 19, 2024: Announced plans to acquire C&H Technologies, a leading provider of critical environment solutions, including thermal management technologies for data centers and electronics.

- Dec 15, 2023: Launched a new series of advanced liquid coolants formulated for high-performance electronics, offering superior thermal conductivity and reduced environmental impact.

Intel Corporation:

- Jan 18, 2024: Showcased its next-generation integrated heat spreader (IHS) technology for its 14th Gen Core processors, featuring enhanced surface area and heat pipe integration for improved heat dissipation.

- Oct 27, 2023: Announced plans to collaborate with universities and research labs on novel thermal management solutions for future generations of processors and datacenter equipment.

Parker Hannifin Corporation:

- Jan 17, 2024: Reported record revenue for its thermal management division, driven by rising demand for its compact and energy-efficient heat exchangers in industrial automation and medical equipment.

- Dec 5, 2023: Released a new series of microfluidic cooling loops for high-power lasers and medical imaging systems, offering precise temperature control and minimal energy consumption.