Market Analysis

In-depth Analysis of Thermal Systems Market Industry Landscape

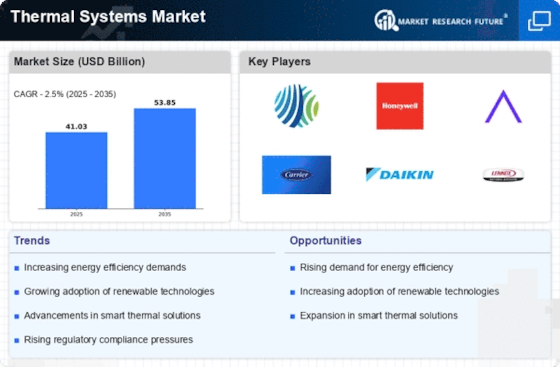

The market dynamics of the Thermal Systems Market are shaped by a range of interconnected factors that influence its growth, trends, and overall functioning. One crucial dynamic is the ever-evolving technological landscape. Advances in technology continually drive innovation within the thermal systems industry. From more energy-efficient HVAC systems to the integration of smart and connected features, technological developments play a pivotal role in shaping the market dynamics. Companies that stay abreast of these technological shifts position themselves for success in a market that demands efficiency and sustainability.

Economic factors also exert a significant influence on the market dynamics of thermal systems. Fluctuations in global economic conditions impact construction and industrial activities, major consumers of thermal systems. Economic downturns may lead to a slowdown in construction projects, affecting the demand for heating and cooling solutions. Conversely, periods of economic growth can spur increased construction activities, driving the market for thermal systems.

Government regulations and policies contribute to the dynamic nature of the thermal systems market. With a growing emphasis on energy efficiency and environmental sustainability, governments worldwide are enacting strict regulations to curb emissions and promote greener solutions. Compliance with these regulations not only shapes product development but also influences consumer choices, as eco-friendly options become increasingly sought after in the market.

Consumer preferences and awareness are key drivers of market dynamics in the thermal systems industry. As environmental consciousness grows, consumers are inclined towards products that align with sustainability goals. This shift in consumer preferences has prompted manufacturers to focus on developing energy-efficient and eco-friendly thermal systems. Additionally, the rise of smart technology has led to increased demand for connected and intelligent thermal solutions that offer greater control and convenience.

Market competition and industry consolidation contribute to the dynamic nature of the thermal systems market. Intense competition among various players fosters innovation, with companies striving to differentiate their products through features, pricing, and overall performance. Mergers and acquisitions within the industry also impact market dynamics by reshaping the competitive landscape and influencing the market share of key players.

Geopolitical factors introduce an element of uncertainty into the thermal systems market dynamics. Trade tensions, political instability, and changes in diplomatic relations can disrupt the global supply chain for thermal system components. Companies in the industry must navigate geopolitical challenges to ensure a stable supply of raw materials and components, which can, in turn, impact pricing and product availability.

Societal trends and demographic shifts play a role in shaping the market dynamics of thermal systems. Urbanization, changing lifestyles, and an aging population influence the demand for different types of thermal solutions. Urban dwellers may prioritize compact and efficient HVAC systems, while an aging population may drive demand for heating solutions that cater to specific comfort needs. Adapting to these societal trends is essential for companies looking to stay relevant and responsive to market dynamics.

Leave a Comment