Rising Disposable Income

The increasing disposable income among Thai consumers significantly impacts the vitamins market. As individuals have more financial resources, they are more inclined to invest in health-related products, including vitamins and supplements. This trend is particularly evident in urban areas, where consumers are more exposed to health trends and premium products. Market analysis suggests that the vitamins market could see a revenue increase of up to 15% in the coming years, driven by this economic uplift. Consumers are likely to prioritize health expenditures, leading to a greater demand for high-quality vitamins that promise enhanced health benefits. This shift in spending habits is expected to encourage brands to diversify their offerings to meet the evolving preferences of health-conscious consumers.

Focus on Preventive Healthcare

The increasing emphasis on preventive healthcare is reshaping the vitamins market in Thailand. Consumers are becoming more proactive about their health, seeking vitamins as a means to prevent illness rather than merely treating it. This shift is supported by a growing body of research highlighting the role of vitamins in maintaining overall health and preventing chronic diseases. The vitamins market is likely to respond to this trend by expanding its product lines to include formulations that target specific health concerns, such as immunity and heart health. Market forecasts suggest that this focus on preventive measures could lead to a growth rate of around 12% in the vitamins sector over the next few years, reflecting a broader societal shift towards health optimization.

Increased Nutritional Awareness

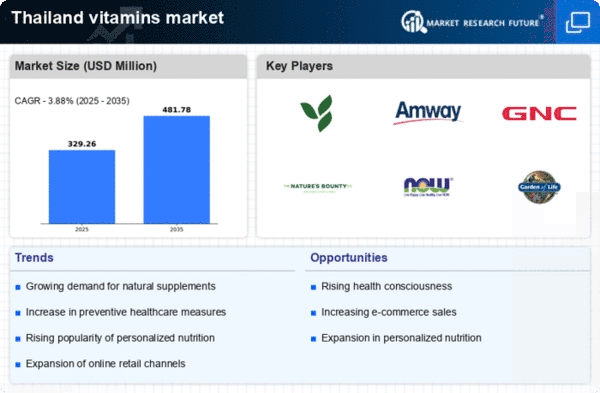

The vitamins market in Thailand experiences a notable boost due to the rising awareness of nutritional health among consumers. This trend is driven by educational campaigns and the proliferation of health information through various media. As individuals become more informed about the benefits of vitamins, the demand for dietary supplements increases. Recent data indicates that the market is projected to grow at a CAGR of approximately 8% over the next five years. This growth reflects a shift in consumer behavior towards preventive healthcare, where individuals actively seek vitamins to enhance their well-being. Consequently, the vitamins market is likely to see a surge in product innovation, with companies developing specialized formulations to cater to diverse health needs.

Government Initiatives and Regulations

Government policies and regulations play a crucial role in shaping the vitamins market in Thailand. The Thai government has implemented various initiatives aimed at promoting health and wellness, which include guidelines for dietary supplements. These regulations ensure product safety and efficacy, thereby enhancing consumer trust in vitamins. Furthermore, the government encourages local production of vitamins, which may lead to reduced costs and increased accessibility for consumers. As a result, the vitamins market is likely to benefit from a more structured environment that fosters growth and innovation. The regulatory framework also supports the introduction of new products, which could further stimulate market expansion.

Influence of Social Media and Digital Marketing

The role of social media and digital marketing in shaping consumer preferences is increasingly evident in the vitamins market. Platforms such as Instagram and Facebook serve as vital channels for brands to engage with consumers, promoting the benefits of vitamins through influencer partnerships and targeted advertising. This digital presence not only raises awareness but also drives sales, as consumers are more likely to purchase products they see endorsed by trusted figures. The vitamins market is adapting to this trend by investing in online marketing strategies, which could lead to a projected growth of 10% in online sales channels over the next few years. This shift indicates a transformation in how consumers discover and purchase vitamins, emphasizing the importance of a robust online presence.