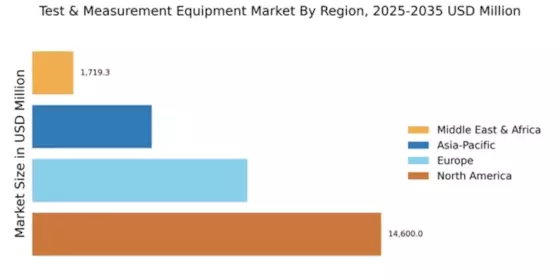

North America : Market Leader in Innovation

North America continues to lead the Test & Measurement Equipment Market, holding a significant share of approximately 14600.0 million in 2024. The region's growth is driven by rapid technological advancements, increased R&D investments, and a strong focus on quality assurance across various industries. Regulatory support for innovation and safety standards further catalyzes demand, ensuring that North America remains at the forefront of market development. The competitive landscape is characterized by the presence of major players such as Keysight Technologies, Tektronix, and Fluke Corporation, which contribute to a robust ecosystem. The U.S. stands out as a key market, supported by a strong manufacturing base and a high demand for advanced testing solutions. This competitive environment fosters continuous innovation, ensuring that North America retains its leadership position in the global market.

Europe : Growing Demand and Innovation

Europe's Test & Measurement Equipment Market is projected to reach approximately 9000.0 million by 2025, driven by increasing automation and stringent regulatory requirements across various sectors. The region's focus on sustainability and energy efficiency is also propelling demand for advanced testing solutions. Regulatory frameworks, such as the EU's directives on product safety and environmental standards, are key catalysts for market growth, ensuring compliance and innovation in testing methodologies. Leading countries like Germany, the UK, and France are at the forefront of this market, with a strong presence of key players such as Rohde & Schwarz and Agilent Technologies. The competitive landscape is marked by collaborations and partnerships aimed at enhancing product offerings and technological capabilities. This dynamic environment positions Europe as a significant player in the global Test & Measurement Equipment Market.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is experiencing significant growth in the Test & Measurement Equipment Market, projected to reach around 5000.0 million by 2025. This growth is fueled by increasing industrialization, rising investments in infrastructure, and a growing emphasis on quality control across various sectors. Additionally, government initiatives aimed at promoting manufacturing and technological advancements are acting as strong growth drivers, enhancing the region's market potential. Countries like China, Japan, and India are leading the charge, with a burgeoning demand for advanced testing solutions. The competitive landscape features key players such as Anritsu Corporation and B&K Precision, which are actively expanding their market presence. This dynamic environment, coupled with a focus on innovation, positions Asia-Pacific as a vital region in the global Test & Measurement Equipment Market.

Middle East and Africa : Developing Market Landscape

The Middle East & Africa region is gradually emerging in the Test & Measurement Equipment Market, with a projected size of approximately 1719.3 million by 2025. The growth is driven by increasing investments in infrastructure, telecommunications, and energy sectors. Additionally, the region's focus on enhancing technological capabilities and regulatory compliance is fostering demand for advanced testing solutions, creating a conducive environment for market expansion. Countries like South Africa and the UAE are leading the market, supported by government initiatives aimed at boosting industrial growth. The competitive landscape is characterized by a mix of local and international players, which enhances market dynamics. This evolving environment presents significant growth opportunities for stakeholders in the Test & Measurement Equipment sector.