Increased Regulatory Compliance

The Terrain Awareness Warning System Market is significantly influenced by heightened regulatory compliance requirements across various aviation sectors. Regulatory bodies are mandating the installation of terrain awareness systems in commercial and military aircraft to enhance safety measures. This trend is particularly evident in regions where aviation safety standards are being rigorously enforced. The market is expected to witness a substantial increase in demand as manufacturers strive to meet these compliance standards. Furthermore, the push for compliance is likely to drive innovation within the industry, as companies develop more advanced systems that not only meet but exceed regulatory expectations.

Rising Demand for Commercial Aviation

The Terrain Awareness Warning System Market is poised for growth due to the rising demand for commercial aviation. As air travel continues to expand, airlines are increasingly investing in advanced safety systems to ensure passenger safety and operational reliability. The market is projected to benefit from the increasing number of aircraft deliveries, with estimates suggesting that the global fleet will grow significantly in the coming years. This trend is likely to drive the adoption of terrain awareness systems, as airlines seek to enhance their safety protocols and comply with evolving regulatory standards. Consequently, the market is expected to witness a robust increase in the installation of these systems across new and existing aircraft.

Focus on Human Factors in Aviation Safety

The Terrain Awareness Warning System Market is increasingly focusing on human factors that contribute to aviation safety. Research indicates that human error remains a leading cause of aviation accidents, prompting a shift towards systems that enhance situational awareness for pilots. By integrating user-friendly interfaces and intuitive alerts, terrain awareness systems are designed to assist pilots in making informed decisions during critical phases of flight. This focus on human factors is expected to drive market growth, as airlines and operators recognize the importance of equipping their fleets with systems that prioritize pilot safety and operational efficiency.

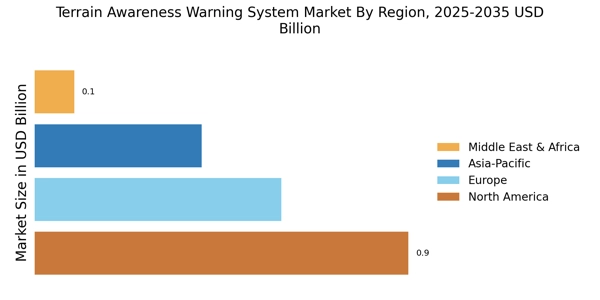

Emerging Markets and Increased Air Traffic

The Terrain Awareness Warning System Market is also being driven by emerging markets and the corresponding increase in air traffic. Countries with developing aviation sectors are investing in modernizing their fleets, which includes the integration of terrain awareness systems. As air traffic continues to rise, the need for enhanced safety measures becomes more pronounced. This trend is particularly relevant in regions where air travel is becoming more accessible to the general population. The market is likely to see a surge in demand as these emerging markets prioritize safety and efficiency in their aviation operations, thereby creating opportunities for manufacturers of terrain awareness systems.

Technological Advancements in Terrain Awareness Warning Systems

The Terrain Awareness Warning System Market is experiencing a surge in technological advancements, which are enhancing the capabilities of these systems. Innovations such as improved sensor technologies, advanced algorithms, and integration with artificial intelligence are driving the market forward. For instance, the incorporation of real-time data processing allows for more accurate terrain mapping and obstacle detection. As a result, the market is projected to grow at a compound annual growth rate of approximately 7% over the next five years. This growth is indicative of the increasing demand for sophisticated systems that can provide pilots with critical information, thereby reducing the risk of accidents and improving overall flight safety.