Rising Demand for Customization

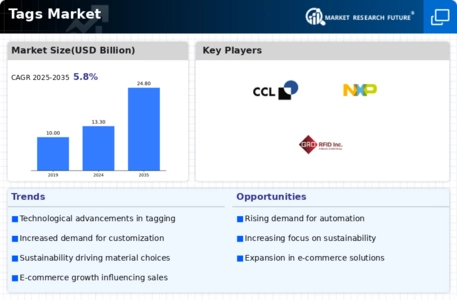

The Tags Market experiences a notable surge in demand for customized tags, driven by consumer preferences for personalized products. This trend is particularly evident in sectors such as fashion, where brands increasingly offer tailored tagging solutions to enhance customer engagement. According to recent data, the customization segment within the Tags Market is projected to grow at a compound annual growth rate of 8.5% over the next five years. This growth is indicative of a broader shift towards individualized consumer experiences, compelling manufacturers to innovate and diversify their offerings. As businesses strive to differentiate themselves in a competitive landscape, the ability to provide unique tagging solutions becomes a critical factor in capturing market share.

Growth of E-commerce and Online Retail

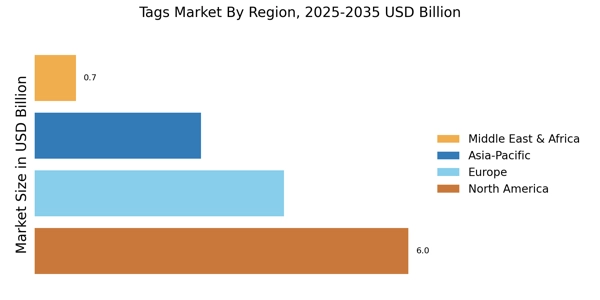

The proliferation of e-commerce has a profound impact on the Tags Market, as online retailers require efficient tagging solutions to manage their vast inventories. With e-commerce sales projected to surpass USD 6 trillion by 2024, the demand for effective tagging systems is expected to rise correspondingly. Tags Market serve as essential tools for product identification, inventory tracking, and shipping logistics, making them indispensable in the online retail landscape. As businesses adapt to the digital marketplace, the Tags Market is likely to experience accelerated growth, driven by the need for innovative tagging solutions that enhance operational efficiency and customer experience.

Sustainability Initiatives in Packaging

Sustainability initiatives are increasingly influencing the Tags Market, as consumers and businesses alike prioritize eco-friendly practices. The demand for biodegradable and recyclable tags is on the rise, reflecting a broader commitment to reducing environmental impact. Recent studies indicate that the sustainable packaging market is expected to grow at a CAGR of 7.5% through 2027, which directly correlates with the Tags Market's shift towards greener alternatives. Companies that adopt sustainable tagging solutions not only meet regulatory requirements but also appeal to environmentally conscious consumers, thereby enhancing their brand reputation and market position.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are critical drivers in the Tags Market, particularly in sectors such as food and pharmaceuticals. Stringent labeling requirements necessitate the use of compliant tags that convey essential information to consumers. The market for compliant tagging solutions is projected to grow as businesses seek to adhere to evolving regulations. For instance, the food industry is expected to see a 5% increase in demand for compliant tags by 2026, driven by heightened consumer awareness regarding product safety. As companies navigate these regulatory landscapes, the Tags Market must adapt to ensure that tagging solutions meet safety and compliance standards, thereby fostering consumer trust.

Technological Advancements in Tagging Solutions

Technological advancements play a pivotal role in shaping the Tags Market, particularly through the integration of RFID and NFC technologies. These innovations facilitate enhanced tracking and inventory management, which are essential for retailers and manufacturers alike. The adoption of smart tags is on the rise, with the market for RFID tags alone expected to reach USD 10 billion by 2026. This technological evolution not only streamlines operations but also enhances consumer interaction with products, thereby driving sales. As businesses increasingly recognize the value of these advanced tagging solutions, the Tags Market is likely to witness a significant transformation, characterized by improved efficiency and customer satisfaction.