Market Analysis

In-depth Analysis of Tags Market Industry Landscape

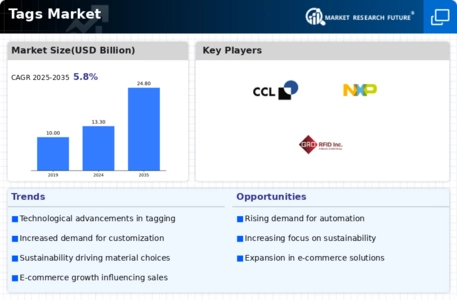

The tags market encompasses a wide range of products used for labeling, identification, and tracking purposes across various industries. Tags come in different forms, including barcode tags, RFID tags, NFC tags, and QR code tags, each serving specific functions and applications. The dynamics of this market are influenced by factors such as technological advancements, industry trends, regulatory requirements, and evolving consumer preferences.

Technological advancements play a pivotal role in shaping the dynamics of the tags market. Continuous innovation in tag manufacturing processes, materials, and encoding technologies has led to the development of tags with enhanced functionality, durability, and performance. For example, advancements in RFID (Radio Frequency Identification) technology have enabled the development of smaller, more energy-efficient tags capable of storing and transmitting large amounts of data wirelessly. Similarly, improvements in printing and encoding techniques have made it possible to produce high-quality barcode and QR code tags with increased readability and scanning accuracy.

Industry trends also impact the dynamics of the tags market. Factors such as the growing adoption of automation, digitization, and e-commerce drive demand for tags used in inventory management, logistics, and supply chain optimization. Tags play a crucial role in enabling real-time tracking and tracing of goods and assets, helping companies improve operational efficiency, reduce errors, and enhance customer satisfaction. Moreover, the increasing emphasis on product authenticity, brand protection, and anti-counterfeiting measures fuels demand for tags with unique identification features and security enhancements.

Regulatory requirements and standards influence the dynamics of the tags market, particularly in industries such as healthcare, pharmaceuticals, and food and beverage. Tags used in these sectors must comply with industry-specific regulations related to product labeling, traceability, and safety. For example, pharmaceutical companies are required to use serialized barcode tags on drug packaging to enable traceability and prevent counterfeit medicines from entering the supply chain. Similarly, food manufacturers must adhere to labeling regulations that require the inclusion of product information, allergen warnings, and expiration dates on packaging tags.

Economic conditions and market trends also shape the dynamics of the tags market. Fluctuations in consumer spending, industrial output, and global trade can impact demand for tags across various end-use sectors. Economic downturns may lead to reduced investment in automation and digitalization initiatives, affecting demand for tags used in manufacturing and logistics applications. Conversely, periods of economic growth and recovery stimulate demand for tags as companies seek to improve efficiency, reduce costs, and gain a competitive edge in the market.

Consumer preferences and behaviors influence the dynamics of the tags market, particularly in retail and consumer goods industries. Tags are used in retail environments for product labeling, pricing, and promotion purposes, influencing consumer purchasing decisions and brand loyalty. As consumers increasingly demand transparency, sustainability, and personalized shopping experiences, retailers may invest in innovative tagging solutions such as smart tags and interactive packaging to enhance the customer experience and drive sales.

Leave a Comment