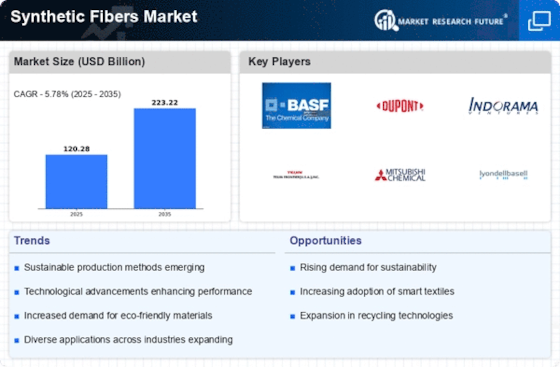

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Synthetic Fibers Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Synthetic Fibers Industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Synthetic Fibers Industry to benefit clients and increase the market sector. In recent years, the Synthetic Fibers Industry has offered some of the most significant advantages to medicine. Major players in the Synthetic Fibers Market, including Lenzing AG, Toyobo Co. Ltd, Bombay Dyeing Inc., Reliance Industries Limited, Toray Chemical Korea, Inc., TEIJIN LIMITED, China Petrochemical Corporation, Mitsubishi Chemical Corporation, DuPont, and Indorama Corporation, are attempting to increase market demand by investing in research and development operations.

Teijin Ltd. (Teijin) is a technology-focused holding corporation that provides solutions in the fields of healthcare, environment and energy, information and electronics, and safety and protection. It produces and sells aramid fiber, carbon fiber goods, synthetic fiber, films, polyester films, resin products, chemical products, IT products, medications, and water purification systems. It also creates and distributes IT products. The business sells medications for the treatment of conditions such as respiratory, cardiovascular, metabolic, and other illnesses as well as ailments of the bones and joints. Devices for home oxygen therapy and those connected to sleep disordered breathing are also available.

Teijin has operations in Asia, Europe, America, and Japan. The business offers its goods across Europe, the Americas, and Asia. Tokyo, Japan is home to Teijin's headquarters. The TenaxTM carbon fiber prepreg from Teijin Limited was chosen in June 2021 for a part of the nacelle, or streamlined housing, for a future Airbus next-generation aircraft engine.

Fabrics and ready-to-wear clothing are produced and sold by Raymond Ltd. The company's product line comprises blankets, clothes, jeans, woollen coats, shirts and pants. Additionally, it offers files, power tools, and automobile parts like water pump bearings, flexplates, and ring gears. The business sells items for personal hygiene, such as PPE kits, sanitizers, and cleansers. Under the brand names Raymond Ready to Wear (RRTW), Park Avenue, ColorPlus, Ethnix, Next Look, and Parx, the company sells textiles and clothing. The corporation also operates non-scheduled airlines and engages in real estate development.

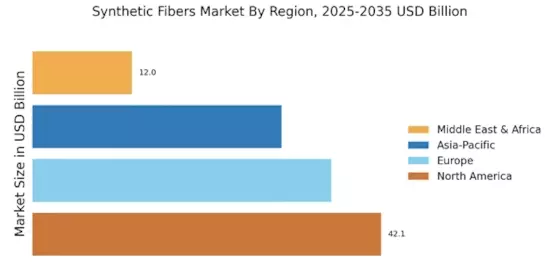

It exports goods to the Middle East, the US, Canada, Japan, and Europe. The headquarters of Raymond are in Mumbai, Maharashtra, India.

In April Raymond Group announced Ecovera, a line of fabrics that are manufactured with one of Reliance Industries Limited's most innovative technologies and are environmentally friendly.