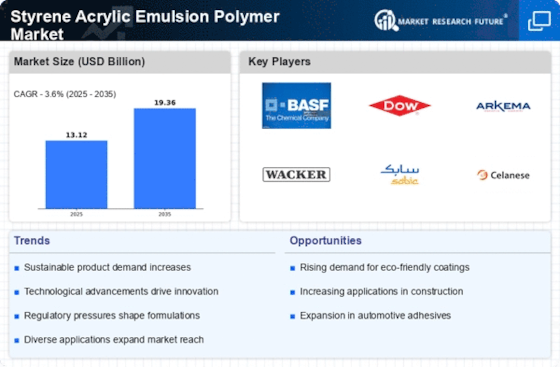

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Styrene Acrylic Emulsion Polymer Market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Styrene Acrylic Emulsion Polymer industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Styrene Acrylic Emulsion Polymer industry to benefit clients and increase the market sector. In recent years, the Styrene Acrylic Emulsion Polymer industry has offered some of the most significant advantages to medicine. Major players in the Styrene Acrylic Emulsion Polymer Market, including Celanese Corporation, Pexi Chem Private Limited., The Dow Chemical Company, B. Fuller, Acquos, Xyntra Chemicals B.V., and The Lubrizol Corporation, are attempting to increase market demand by investing in research and development operations.

BASF SE (BASF) is a company that produces chemicals. It manufactures, markets, and sells chemicals, polymers, crop protection products, and performance items. The company's product line includes solvents, adhesives, surfactants, fuel additives, electronic chemicals, pigments, paints, food additives, fungicides, and herbicides. The company works with a wide range of industries, including those related to building, woodworking, agriculture, electronics and electrical, paints and coatings, transportation, home care, nutrition, and chemicals. In partnership with international customers, partners, and researchers, BASF carries out R&D. The company's operations are supported by a network of production facilities.

It can be found all over the world, including in North America, Europe, Asia, South America, Africa, and the Middle East. The BASF corporate headquarters are in Ludwigshafen, Germany. The business claims that in July 2022, BASF will have finished constructing and operating a state-of-the-art acrylic emulsions production line in Dahej, India. The capacity of the polymer dispersions that BASF began manufacturing in Dahej, India, would nearly increase with the addition of this additional production line.

A company that specializes in chemicals is Synthomer PLC. It provides a range of chemicals, such as adhesives and latex, utilized in a variety of industries, including construction, coatings, textiles, paper, and healthcare. Styrene-butadiene rubber, used to create coated paper, packaging, carpet bindings, foam mattresses, pillows, and shoes, as well as nitrile-butadiene latex, used to make medical gloves and catheters, are among the company's goods. Performance elastomers, functional solutions, industrial specialties, adhesive Technologies, and acrylate monomers make up the company's five divisions. Performance elastomers and functional solutions together account for a significant portion of the company's sales.

The adhesives resins division of Eastman Chemical was purchased by Synthomer PLC for USD 1 billion in November 2021. The acquisition was made in order to broaden the reach of the company's goods and services as well as its product portfolio, which now includes polyolefin polymers, pure monomer resins and dispersions, fatty acid-based resins, and oleochemical product lines.