Evolving Risk Landscape

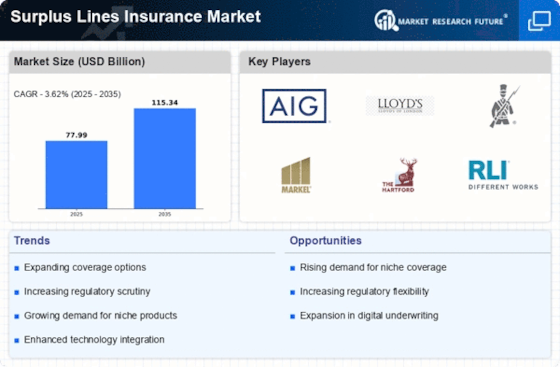

The Surplus Lines Insurance Market is experiencing a notable shift due to the evolving risk landscape. As businesses face increasingly complex risks, traditional insurance may not suffice. This has led to a surge in demand for surplus lines, which provide coverage for unique and high-risk scenarios. For instance, the market for surplus lines has expanded significantly, with premiums reaching approximately 50 billion dollars in recent years. This growth indicates a strong inclination towards specialized coverage options that cater to specific industry needs. Furthermore, the rise of emerging risks, such as cyber threats and climate-related events, necessitates innovative insurance solutions, thereby propelling the surplus lines sector forward. Insurers are adapting to these changes, suggesting a robust future for the Surplus Lines Insurance Market.

Global Economic Factors

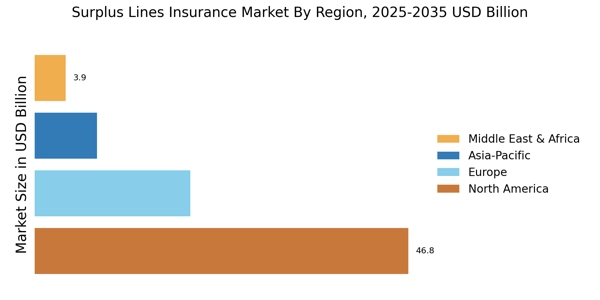

Economic factors are playing a crucial role in shaping the Surplus Lines Insurance Market. Fluctuations in the economy can influence the demand for insurance products, particularly in sectors that are more susceptible to economic cycles. For instance, during periods of economic growth, businesses may seek additional coverage to protect against potential risks associated with expansion. Conversely, economic downturns may lead to a reevaluation of insurance needs. As of October 2025, the surplus lines market is adapting to these economic dynamics, with insurers adjusting their strategies to align with changing market conditions. This adaptability is essential for maintaining competitiveness and ensuring sustainability within the Surplus Lines Insurance Market. The interplay between economic trends and insurance demand is likely to continue influencing the market landscape.

Technological Integration

Technological integration is a driving force within the Surplus Lines Insurance Market, as advancements in data analytics and artificial intelligence are transforming risk assessment and underwriting processes. Insurers are increasingly leveraging technology to enhance their operational efficiency and improve customer experiences. For example, the use of predictive analytics allows insurers to better understand risk profiles and tailor coverage accordingly. This trend is reflected in the growing investment in insurtech, which is projected to reach over 10 billion dollars by 2026. Such investments indicate a strong belief in the potential of technology to revolutionize the surplus lines sector. As technology continues to evolve, it is likely to play a pivotal role in shaping the future of the Surplus Lines Insurance Market, enabling insurers to offer more customized and efficient solutions.

Increased Regulatory Scrutiny

The Surplus Lines Insurance Market is currently navigating a landscape marked by increased regulatory scrutiny. Regulatory bodies are imposing stricter guidelines to ensure consumer protection and market stability. This trend has led to a heightened focus on compliance, which can be both a challenge and an opportunity for surplus lines insurers. As of 2025, the industry is witnessing a rise in compliance costs, which could potentially impact profitability. However, this regulatory environment also encourages innovation, as insurers seek to develop products that meet new standards while addressing unique risks. The ability to adapt to these regulatory changes may determine the competitive edge of surplus lines providers in the market. Thus, the interplay between regulation and innovation is likely to shape the future trajectory of the Surplus Lines Insurance Market.

Rising Awareness of Specialty Risks

The Surplus Lines Insurance Market is witnessing a rise in awareness regarding specialty risks among businesses and consumers alike. As industries evolve, the recognition of unique and niche risks has become more pronounced. This awareness is driving demand for surplus lines insurance, which caters to these specific needs. For instance, sectors such as entertainment, technology, and environmental services are increasingly seeking tailored coverage options that traditional insurers may not provide. The market for surplus lines is projected to grow at a compound annual growth rate of approximately 5% over the next few years, reflecting this increasing demand. Consequently, insurers are expanding their offerings to include more specialized products, thereby enhancing their competitive positioning within the Surplus Lines Insurance Market.