Top Industry Leaders in the Superabsorbent Polymers Market

Superabsorbent polymers (SAPs), those seemingly innocuous granules, hold a surprising amount of liquid – hundreds of times their own weight! This remarkable ability propels them to the forefront of a vibrant global market, estimated to explore the strategic maneuvers, influential factors, and recent developments shaping this dynamic landscape where giants soak up market share alongside nimble innovators.

Strategies Absorbing Growth:

- Feedstock Diversification: Moving beyond traditional petroleum-based SAPs, companies like Nippon Shokubai are exploring bio-based options derived from cornstarch or cellulose, responding to sustainability concerns and expanding feedstock security.

- Technological Twists: R&D labs are bubbling with advancements. Evonik Industries is pioneering new crosslinking techniques to improve SAP absorbency and durability, catering to demanding applications like agriculture and water management.

- Product Diversification: Leading players like BASF are going beyond standard hygiene-grade SAPs to develop specialized variants for niche applications like medical wound dressings and industrial spill management.

- Regional Expansion: Asia-Pacific, with its burgeoning baby care and hygiene industries, holds immense potential. Companies like Sumitomo Chemical are setting up production facilities in this region to capitalize on the local demand.

- Strategic Partnerships: Collaboration strengthens the flow. For instance, Sandia National Laboratories partnered with a diaper manufacturer to develop SAPs with built-in odor control, creating a game-changer for the hygiene market.

Factors Dictating Market Share:

- Absorbency Prowess: Superior liquid holding capacity and gel strength are crucial metrics. Established brands like LG Chem have built reputations for consistent performance, attracting loyal customers.

- Cost-Effectiveness: Price remains a critical factor, particularly in mature markets. Chinese manufacturers often offer lower prices, challenging established players to optimize production and pricing strategies while maintaining quality.

- Regulatory Landscape: Stringent regulations on biodegradability and environmental impact dictate industry practices. Players who comply with these regulations, like Evonik with its closed-loop production cycles, gain a competitive edge.

- Application Diversity: Catering to diverse industries offers resilience. Companies with broad product portfolios like Dow Chemical benefit from diversification, mitigating risks in saturated segments.

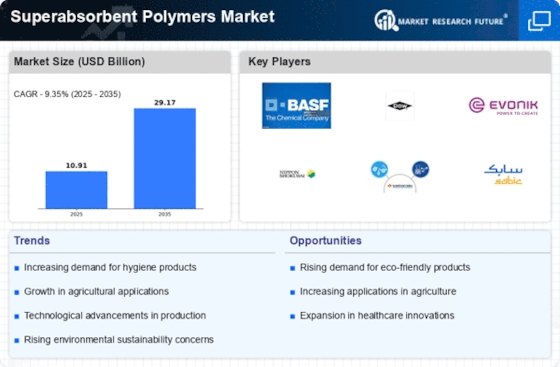

Key Players:

- BASF SE

- Nippon Shokubai Co. Ltd.

- Evonik Industries AG

- SDP Co. Ltd.

- Formosa Plastics Corporation

- KAO Corporation

- LG Chem Ltd.

- SDP Co. Ltd.

- Sumitomo Seika Chemicals Co. Ltd.

- Songwon Industrial Co. Ltd.

- Yixing Danson Technology

Recent Developments :

- September 2023: BASF launches a new line of SAPs specifically designed for medical wound dressings, offering improved healing rates and patient comfort.

- October 2023: Sumitomo Chemical collaborates with a leading agricultural technology company to develop customized SAPs for smart irrigation systems, aiming to optimize water usage and agricultural yields.

- November 2023: Sandia National Laboratories and its diaper partner successfully commercialize their odor-control SAP solution, revolutionizing the diaper market and addressing a major consumer pain point.

- December 2023: A consortium of research institutions and chemical companies receives government funding to develop next-generation SAPs with self-healing properties, potentially extending product lifespan and reducing waste.