Growth in the Medical Sector

The Superabsorbent Polymers Market is also experiencing growth driven by the medical sector. Superabsorbent polymers are increasingly utilized in wound care products, surgical dressings, and other medical applications due to their excellent absorbent properties. The ability to manage exudate effectively is critical in wound healing, and superabsorbent polymers provide a solution that enhances patient comfort and promotes faster recovery. Market data indicates that the medical application segment is expected to grow significantly, driven by an aging population and increasing healthcare expenditures. This trend highlights the versatility of superabsorbent polymers and their potential to address diverse needs across various industries.

Advancements in Polymer Technology

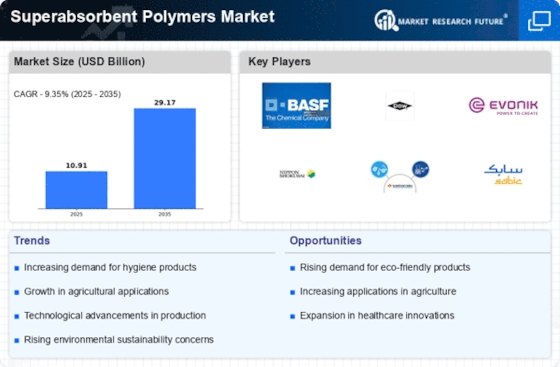

Innovations in polymer technology are playing a pivotal role in shaping the Superabsorbent Polymers Market. Recent advancements have led to the development of new formulations that enhance the absorbency and efficiency of these materials. For instance, the introduction of cross-linked polymers has significantly improved the water retention capabilities of superabsorbent polymers. This technological evolution not only meets the growing consumer expectations for performance but also opens avenues for new applications across various sectors, including agriculture and medical fields. Market analysis suggests that these advancements could potentially lead to a compound annual growth rate (CAGR) of over 5% in the coming years, reflecting the industry's adaptability and innovation.

Expanding Applications in Agriculture

The Superabsorbent Polymers Market is witnessing an expansion in applications within the agricultural sector. These polymers are increasingly being used to improve soil moisture retention, which is crucial for enhancing crop yields, especially in arid regions. The ability of superabsorbent polymers to absorb and release water gradually makes them invaluable for farmers looking to optimize irrigation practices. Market trends suggest that the agricultural segment is poised for growth, with an increasing number of farmers adopting these technologies to combat water scarcity. This trend not only supports agricultural productivity but also contributes to the overall growth of the superabsorbent polymers market.

Increasing Demand in Hygiene Products

The Superabsorbent Polymers Market is experiencing a notable surge in demand, particularly within the hygiene products sector. This is largely attributed to the rising awareness regarding personal hygiene and health. Products such as diapers, feminine hygiene products, and adult incontinence products are increasingly utilizing superabsorbent polymers due to their superior absorbency and comfort. Market data indicates that the hygiene segment accounts for a substantial share of the overall superabsorbent polymers market, with projections suggesting continued growth as consumer preferences shift towards high-performance, absorbent materials. The increasing birth rates in certain regions further amplify the demand for baby diapers, thereby driving the superabsorbent polymers market forward.

Rising Awareness of Sustainable Practices

The Superabsorbent Polymers Market is increasingly influenced by the growing emphasis on sustainability and eco-friendly practices. As consumers become more environmentally conscious, there is a rising demand for biodegradable and sustainable superabsorbent polymers. Manufacturers are responding by developing products that not only meet performance standards but also align with environmental goals. This shift is particularly evident in the agricultural sector, where superabsorbent polymers are utilized to enhance water retention in soil, thereby promoting sustainable farming practices. Market data indicates that the demand for sustainable superabsorbent polymers is expected to rise, potentially leading to a significant transformation in product offerings within the industry.